Page 130 - 2019-20 CAFR

P. 130

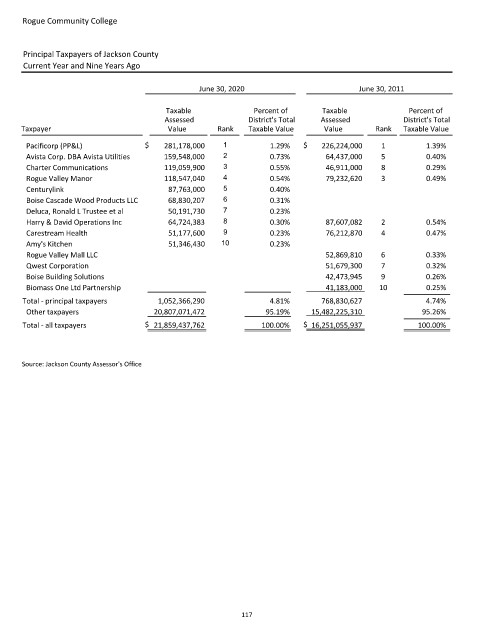

Rogue Community College

Principal Taxpayers of Jackson County

Current Year and Nine Years Ago

June 30, 2020 June 30, 2011

Taxable Percent of Taxable Percent of

Assessed District's Total Assessed District's Total

Taxpayer Value Rank Taxable Value Value Rank Taxable Value

Pacificorp (PP&L) $ 281,178,000 1 1.29% $ 226,224,000 1 1.39%

Avista Corp. DBA Avista Utilities 159,548,000 2 0.73% 64,437,000 5 0.40%

Charter Communications 119,059,900 3 0.55% 46,911,000 8 0.29%

Rogue Valley Manor 118,547,040 4 0.54% 79,232,620 3 0.49%

Centurylink 87,763,000 5 0.40%

Boise Cascade Wood Products LLC 68,830,207 6 0.31%

Deluca, Ronald L Trustee et al 50,191,730 7 0.23%

Harry & David Operations Inc 64,724,383 8 0.30% 87,607,082 2 0.54%

Carestream Health 51,177,600 9 0.23% 76,212,870 4 0.47%

Amy's Kitchen 51,346,430 10 0.23%

Rogue Valley Mall LLC 52,869,810 6 0.33%

Qwest Corporation 51,679,300 7 0.32%

Boise Building Solutions 42,473,945 9 0.26%

Biomass One Ltd Partnership 41,183,000 10 0.25%

Total principal taxpayers 1,052,366,290 4.81% 768,830,627 4.74%

Other taxpayers 20,807,071,472 95.19% 15,482,225,310 95.26%

Total all taxpayers $ 21,859,437,762 100.00% $ 16,251,055,937 100.00%

Source: Jackson County Assessor's Office

117