Page 128 - 2019-20 CAFR

P. 128

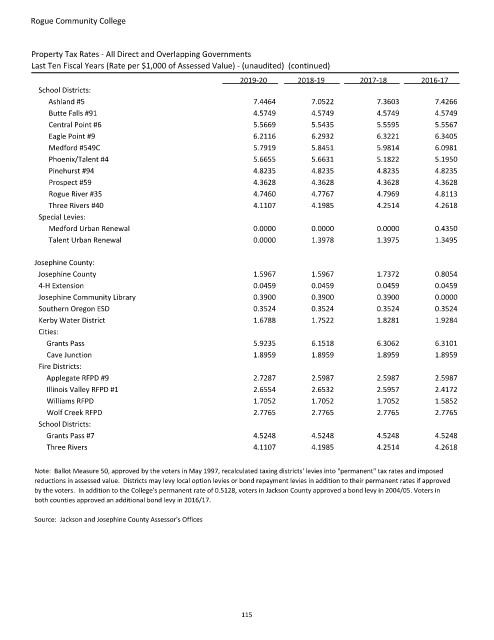

Rogue Community College

Property Tax Rates ‐ All Direct and Overlapping Governments

Last Ten Fiscal Years (Rate per $1,000 of Assessed Value) ‐ (unaudited) (continued)

2019‐20 2018‐19 2017‐18 2016‐17

School Districts:

Ashland #5 7.4464 7.0522 7.3603 7.4266

Butte Falls #91 4.5749 4.5749 4.5749 4.5749

Central Point #6 5.5669 5.5435 5.5595 5.5567

Eagle Point #9 6.2116 6.2932 6.3221 6.3405

Medford #549C 5.7919 5.8451 5.9814 6.0981

Phoenix/Talent #4 5.6655 5.6631 5.1822 5.1950

Pinehurst #94 4.8235 4.8235 4.8235 4.8235

Prospect #59 4.3628 4.3628 4.3628 4.3628

Rogue River #35 4.7460 4.7767 4.7969 4.8113

Three Rivers #40 4.1107 4.1985 4.2514 4.2618

Special Levies:

Medford Urban Renewal 0.0000 0.0000 0.0000 0.4350

Talent Urban Renewal 0.0000 1.3978 1.3975 1.3495

Josephine County:

Josephine County 1.5967 1.5967 1.7372 0.8054

4‐H Extension 0.0459 0.0459 0.0459 0.0459

Josephine Community Library 0.3900 0.3900 0.3900 0.0000

Southern Oregon ESD 0.3524 0.3524 0.3524 0.3524

Kerby Water District 1.6788 1.7522 1.8281 1.9284

Cities:

Grants Pass 5.9235 6.1518 6.3062 6.3101

Cave Junction 1.8959 1.8959 1.8959 1.8959

Fire Districts:

Applegate RFPD #9 2.7287 2.5987 2.5987 2.5987

Illinois Valley RFPD #1 2.6554 2.6532 2.5957 2.4172

Williams RFPD 1.7052 1.7052 1.7052 1.5852

Wolf Creek RFPD 2.7765 2.7765 2.7765 2.7765

School Districts:

Grants Pass #7 4.5248 4.5248 4.5248 4.5248

Three Rivers 4.1107 4.1985 4.2514 4.2618

Note: Ballot Measure 50, approved by the voters in May 1997, recalculated taxing districts' levies into "permanent" tax rates and imposed

reductions in assessed value. Districts may levy local option levies or bond repayment levies in addition to their permanent rates if approved

by the voters. In addition to the College's permanent rate of 0.5128, voters in Jackson County approved a bond levy in 2004/05. Voters in

both counties approved an additional bond levy in 2016/17.

Source: Jackson and Josephine County Assessor's Offices

115