Page 125 - 2019-20 CAFR

P. 125

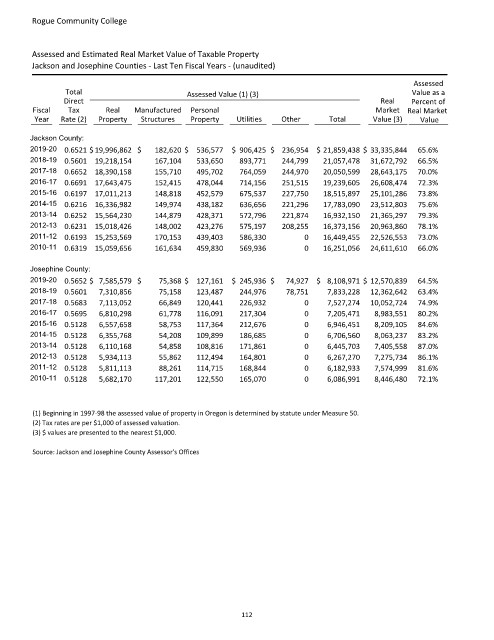

Rogue Community College

Assessed and Estimated Real Market Value of Taxable Property

Jackson and Josephine Counties ‐ Last Ten Fiscal Years ‐ (unaudited)

Assessed

Total Assessed Value (1) (3) Value as a

Direct Real Percent of

Fiscal Tax Real Manufactured Personal Market Real Market

Year Rate (2) Property Structures Property Utilities Other Total Value (3) Value

Jackson County:

2019-20 0.6521 $ 19,996,862 $ 182,620 $ 536,577 $ 906,425 $ 236,954 $ 21,859,438 $ 33,335,844 65.6%

2018-19 0.5601 19,218,154 167,104 533,650 893,771 244,799 21,057,478 31,672,792 66.5%

2017-18 0.6652 18,390,158 155,710 495,702 764,059 244,970 20,050,599 28,643,175 70.0%

2016-17 0.6691 17,643,475 152,415 478,044 714,156 251,515 19,239,605 26,608,474 72.3%

2015-16 0.6197 17,011,213 148,818 452,579 675,537 227,750 18,515,897 25,101,286 73.8%

2014-15 0.6216 16,336,982 149,974 438,182 636,656 221,296 17,783,090 23,512,803 75.6%

2013-14 0.6252 15,564,230 144,879 428,371 572,796 221,874 16,932,150 21,365,297 79.3%

2012-13 0.6231 15,018,426 148,002 423,276 575,197 208,255 16,373,156 20,963,860 78.1%

2011-12 0.6193 15,253,569 170,153 439,403 586,330 0 16,449,455 22,526,553 73.0%

2010-11 0.6319 15,059,656 161,634 459,830 569,936 0 16,251,056 24,611,610 66.0%

Josephine County:

2019-20 0.5652 $ 7,585,579 $ 75,368 $ 127,161 $ 245,936 $ 74,927 $ 8,108,971 $ 12,570,839 64.5%

2018-19 0.5601 7,310,856 75,158 123,487 244,976 78,751 7,833,228 12,362,642 63.4%

2017-18 0.5683 7,113,052 66,849 120,441 226,932 0 7,527,274 10,052,724 74.9%

2016-17 0.5695 6,810,298 61,778 116,091 217,304 0 7,205,471 8,983,551 80.2%

2015-16 0.5128 6,557,658 58,753 117,364 212,676 0 6,946,451 8,209,105 84.6%

2014-15 0.5128 6,355,768 54,208 109,899 186,685 0 6,706,560 8,063,237 83.2%

2013-14 0.5128 6,110,168 54,858 108,816 171,861 0 6,445,703 7,405,558 87.0%

2012-13 0.5128 5,934,113 55,862 112,494 164,801 0 6,267,270 7,275,734 86.1%

2011-12 0.5128 5,811,113 88,261 114,715 168,844 0 6,182,933 7,574,999 81.6%

2010-11 0.5128 5,682,170 117,201 122,550 165,070 0 6,086,991 8,446,480 72.1%

(1) Beginning in 1997‐98 the assessed value of property in Oregon is determined by statute under Measure 50.

(2) Tax rates are per $1,000 of assessed valuation.

(3) $ values are presented to the nearest $1,000.

Source: Jackson and Josephine County Assessor's Offices

112