Page 131 - 2019-20 CAFR

P. 131

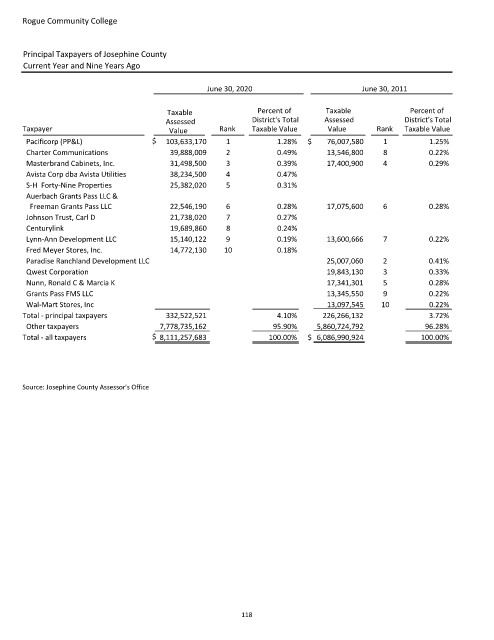

Rogue Community College

Principal Taxpayers of Josephine County

Current Year and Nine Years Ago

June 30, 2020 June 30, 2011

Taxable Percent of Taxable Percent of

Assessed District's Total Assessed District's Total

Taxpayer Value Rank Taxable Value Value Rank Taxable Value

Pacificorp (PP&L) $ 103,633,170 1 1.28% $ 76,007,580 1 1.25%

Charter Communications 39,888,009 2 0.49% 13,546,800 8 0.22%

Masterbrand Cabinets, Inc. 31,498,500 3 0.39% 17,400,900 4 0.29%

Avista Corp dba Avista Utilities 38,234,500 4 0.47%

SH FortyNine Properties 25,382,020 5 0.31%

Auerbach Grants Pass LLC &

Freeman Grants Pass LLC 22,546,190 6 0.28% 17,075,600 6 0.28%

Johnson Trust, Carl D 21,738,020 7 0.27%

Centurylink 19,689,860 8 0.24%

LynnAnn Development LLC 15,140,122 9 0.19% 13,600,666 7 0.22%

Fred Meyer Stores, Inc. 14,772,130 10 0.18%

Paradise Ranchland Development LLC 25,007,060 2 0.41%

Qwest Corporation 19,843,130 3 0.33%

Nunn, Ronald C & Marcia K 17,341,301 5 0.28%

Grants Pass FMS LLC 13,345,550 9 0.22%

WalMart Stores, Inc 13,097,545 10 0.22%

Total principal taxpayers 332,522,521 4.10% 226,266,132 3.72%

Other taxpayers 7,778,735,162 95.90% 5,860,724,792 96.28%

taxpayers

Total all $ 8,111,257,683 100.00% $ 6,086,990,924 100.00%

Source: Josephine County Assessor's Office

118