Page 132 - 2019-20 CAFR

P. 132

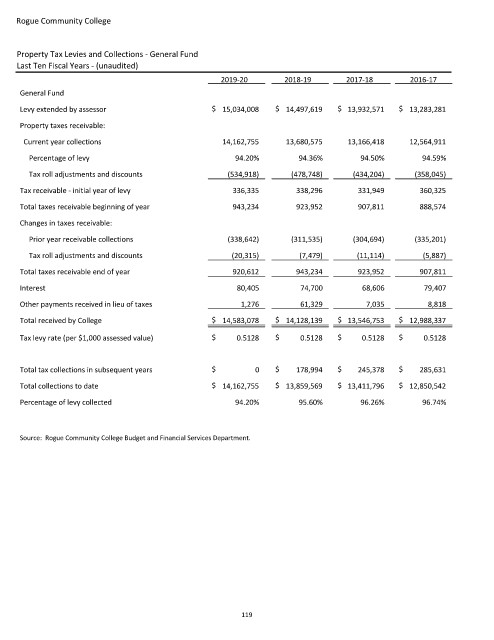

Rogue Community College

Property Tax Levies and Collections General Fund

Last Ten Fiscal Years (unaudited)

201920 201819 201718 201617

General Fund

Levy extended by assessor $ 15,034,008 $ 14,497,619 $ 13,932,571 $ 13,283,281

Property taxes receivable:

Current year collections 14,162,755 13,680,575 13,166,418 12,564,911

Percentage of levy 94.20% 94.36% 94.50% 94.59%

Tax roll adjustments and discounts (534,918) (478,748) (434,204) (358,045)

Tax receivable initial year of levy 336,335 338,296 331,949 360,325

Total taxes receivable beginning of year 943,234 923,952 907,811 888,574

Changes in taxes receivable:

Prior year receivable collections (338,642) (311,535) (304,694) (335,201)

Tax roll adjustments and discounts (20,315) (7,479) (11,114) (5,887)

Total taxes receivable end of year 920,612 943,234 923,952 907,811

Interest 80,405 74,700 68,606 79,407

Other payments received in lieu of taxes 1,276 61,329 7,035 8,818

Total received by College $ 14,583,078 $ 14,128,139 $ 13,546,753 $ 12,988,337

Tax levy rate (per $1,000 assessed value) $ 0.5128 $ 0.5128 $ 0.5128 $ 0.5128

Total tax collections in subsequent years $ 0 $ 178,994 $ 245,378 $ 285,631

Total collections to date $ 14,162,755 $ 13,859,569 $ 13,411,796 $ 12,850,542

levy collected

Percentage of 94.20% 95.60% 96.26% 96.74%

Source: Rogue Community College Budget and Financial Services Department.

119