Page 77 - 2019-20 CAFR

P. 77

Rogue Community College

Notes to Basic Financial Statements

Year ended June 30, 2020

9. Post‐Employment Health Care Costs (continued)

Use of Estimates in the Preparation of the Schedules (RHIA)

The preparation of the Schedules in conformity with accounting principles generally accepted in the

U.S. requires management to make estimates and assumptions that affect certain amounts and

disclosures. Actual results could differ from those estimates.

OPEB Asset, OPEB Expense, and Deferred Outflow of Resources and Deferred Inflow of Resources

Related to OPEB (RHIA)

At June 30, 2020, the College reported an asset of $377,709 for its proportionate share of the net

OPEB asset. The net OPEB asset was measured as of June 30, 2019 and the total OPEB asset used to

calculate the net OPEB asset was determined by an actuarial valuation as of December 31, 2017. The

College’s proportion of the net OPEB asset was based on a projection of the College’s long‐term share

of contributions to the OPEB plan relative to the projected contributions of all participating

employers, actuarially determined. At June 30, 2019, the College’s proportion was 0.195%, which was

a decrease of 0.004% from its proportion measured as of June 30, 2018.

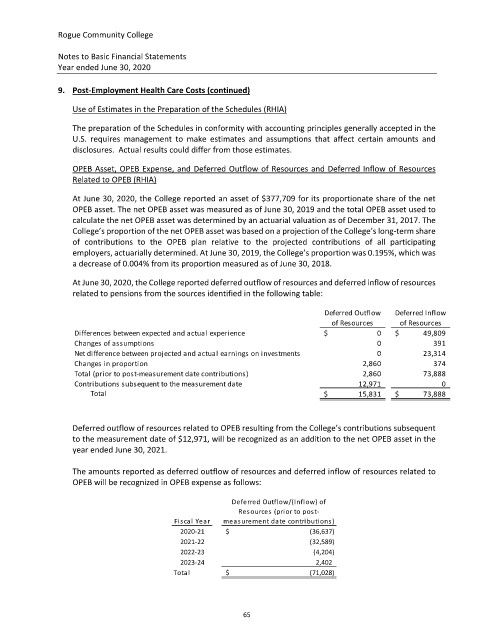

At June 30, 2020, the College reported deferred outflow of resources and deferred inflow of resources

related to pensions from the sources identified in the following table:

Deferred Outflow Deferred Inflow

of Resources of Resources

Differences between expected and actual experience $ 0 $ 49,809

Changes of assumptions 0 391

Net difference between projected and actual earnings on investments 0 23,314

i

n

Changes proportion 2,860 374

Total (prior to post‐measurement date contributions) 2,860 73,888

Contributions subsequent to the measurement date 12,971 0

Total $ 15,831 $ 73,888

Deferred outflow of resources related to OPEB resulting from the College’s contributions subsequent

to the measurement date of $12,971, will be recognized as an addition to the net OPEB asset in the

year ended June 30, 2021.

The amounts reported as deferred outflow of resources and deferred inflow of resources related to

OPEB will be recognized in OPEB expense as follows:

Deferred Outflow/(Inflow) of

post‐

Resources (prior to

Fisca l Year measurement date contributions)

2020‐21 $ (36,637)

2021‐22 (32,589)

2022‐23 (4,204)

2023‐24 2,402

Total $ (71,028)

65