Page 72 - 2019-20 CAFR

P. 72

Rogue Community College

Notes to Basic Financial Statements

Year ended June 30, 2020

9. Post‐Employment Health Care Costs (continued)

Actuarial Assumptions (CA OPEB) (continued)

The increase in employer cost sharing is an assumed increase at the rate of 6% annual until the date

of each employee’s retirement. Any cost increases occurring after the date of retirement are paid by

the retiree.

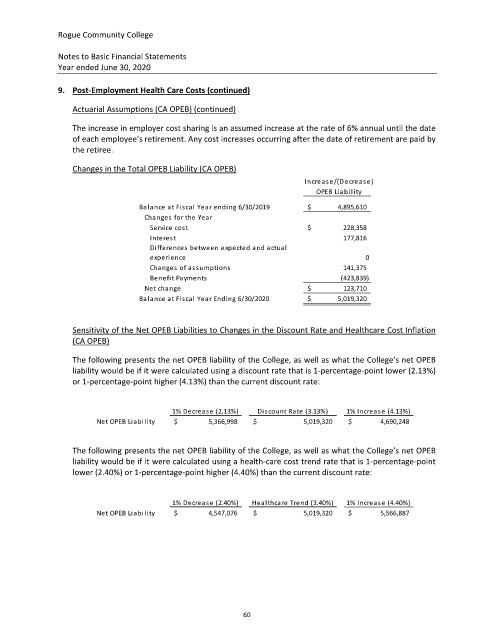

Changes in the Total OPEB Liability (CA OPEB)

Increase/(Decrease)

OPEB Liability

Balance a Year ending 6/30/2019 $ 4,895,610

t Fiscal

Changes for the Year

Service cost $ 228,358

Interest 177,816

Differences between expected and actual

experience 0

Changes of 141,375

assumptions

Benefi t Payments (423,839)

Net change $ 123,710

Balance a Year Ending 6/30/2020 $ 5,019,320

t Fiscal

Sensitivity of the Net OPEB Liabilities to Changes in the Discount Rate and Healthcare Cost Inflation

(CA OPEB)

The following presents the net OPEB liability of the College, as well as what the College’s net OPEB

liability would be if it were calculated using a discount rate that is 1‐percentage‐point lower (2.13%)

or 1‐percentage‐point higher (4.13%) than the current discount rate:

1% Decrease (2.13%) Discount Rate (3.13%) 1% Increase (4.13%)

Net OPEB Liability $ 5,366,998 $ 5,019,320 $ 4,690,248

The following presents the net OPEB liability of the College, as well as what the College’s net OPEB

liability would be if it were calculated using a health‐care cost trend rate that is 1‐percentage‐point

lower (2.40%) or 1‐percentage‐point higher (4.40%) than the current discount rate:

1% Decrease (2.40%) Healthcare Trend (3.40%) 1% Increase (4.40%)

Net OPEB Liability $ 4,547,076 $ 5,019,320 $ 5,566,887

60