Page 71 - 2019-20 CAFR

P. 71

Rogue Community College

Notes to Basic Financial Statements

Year ended June 30, 2020

9. Post‐Employment Health Care Costs (continued)

Funding Policy (CA OPEB) (continued)

appropriations on a pay‐as‐you‐go basis. For the year, ended June 30, 2020, benefit payments under

the plan were $356,891.

Net OPEB Liability (CA OPEB)

The College’s total OPEB liability was measured as of June 30, 2019 and the total liability of $5.01

million was determined by an actuarial valuation dated June 30, 2018. This actuarial valuation

covered a measurement period of June 30, 2018 to June 30, 2019.

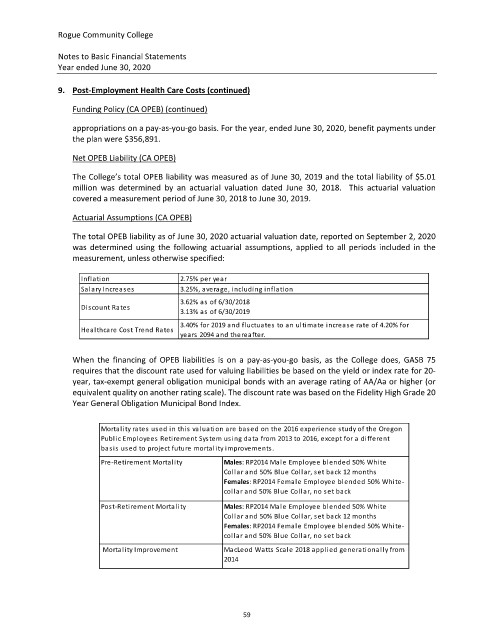

Actuarial Assumptions (CA OPEB)

The total OPEB liability as of June 30, 2020 actuarial valuation date, reported on September 2, 2020

was determined using the following actuarial assumptions, applied to all periods included in the

measurement, unless otherwise specified:

Inflation 2.75% per year

Sa l a ry Increa s es 3.25%, avera ge, including inflation

3.62% a s of 6/30/2018

Discount Rates

3.13% a s of 6/30/2019

Healthcare Cost Trend Rates 3.40% for 2019 a nd fl uctuates to an ultima te increas e rate of 4.20% for

yea rs 2094 a nd therea fter.

When the financing of OPEB liabilities is on a pay‐as‐you‐go basis, as the College does, GASB 75

requires that the discount rate used for valuing liabilities be based on the yield or index rate for 20‐

year, tax‐exempt general obligation municipal bonds with an average rating of AA/Aa or higher (or

equivalent quality on another rating scale). The discount rate was based on the Fidelity High Grade 20

Year General Obligation Municipal Bond Index.

Morta li ty rates used in thi s valua ti on a re ba s ed on the 2016 experi ence s tudy of the Oregon

Publ ic Employees Retirement System using data from 2013 to 2016, except for a different

basi s used to project future mortality improvements.

Pre‐Retirement Mortality Males: RP2014 Ma le Employee blended 50% White

Collar and 50% Blue Collar, set back 12 months

Females: RP2014 Female Employee blended 50% White‐

collar and 50% Blue Collar, no set back

Post‐Retirement Mortality Males: RP2014 Ma le Employee blended 50% White

Collar and 50% Blue Collar, set back 12 months

Females: RP2014 Female Employee blended 50% White‐

collar and 50% Blue Collar, no set back

Mortality Improvement Ma cLeod Watts Scale 2018 applied generationally from

2014

59