Page 69 - 2019-20 CAFR

P. 69

Rogue Community College

Notes to Basic Financial Statements

Year ended June 30, 2020

9. Post‐Employment Health Care Costs

College Administered OPEB (CA OPEB)

Oregon Revised Statutes (ORS) 243.303 requires local governments, including community colleges to

provide retirees with group health care coverage comparable and within the same group as active

employees. The governing body may prescribe reasonable terms and conditions of eligibility and

coverage and set the maximum college paid premium contribution by collective bargaining agreement

or other agreement.

Plan Description (CA OPEB)

The College operates a single‐employer retiree benefit plan OPEB (the Plan) that provides

postemployment health, dental, and vision coverage benefits to eligible employees and their eligible

dependents. The Plan’s health care coverage is provided through the Oregon Educators Benefit Board

(OEBB). The Plan is not a stand‐alone plan and therefore does not issue its own financial statements.

The “Plan” has no assets accumulated in a trust that meets the criteria in paragraph 4 of GASB

Statement 75.

Benefits and eligibility for faculty, academic professionals, and classified staff are established and

amended through collective bargaining with the recognized barging unit for each classification.

Benefits and eligibility for exempt staff are established and amended by the Rogue Community

College Board of Education. The maximum monthly employer paid premium contribution at June 30,

2020 is $2,351.89 and is based upon the active employee’s coverage level in effect at the time of

retirement.

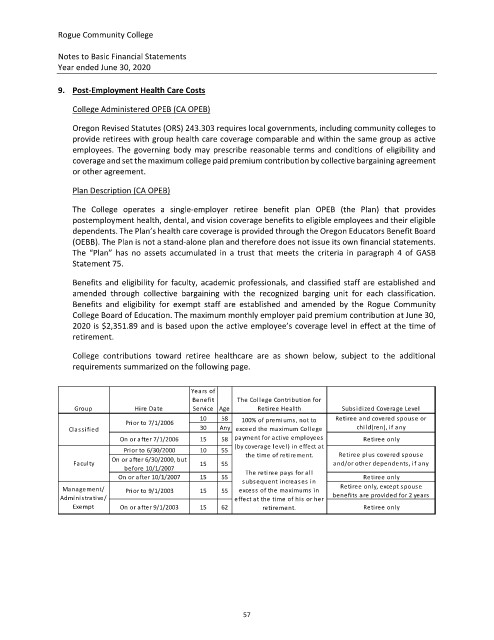

College contributions toward retiree healthcare are as shown below, subject to the additional

requirements summarized on the following page.

o

f

Yea rs

Benefi t The Col lege Contribution for

l

Group Hire Date Service Age Retiree Hea th Subsidized Coverage Level

10 58 100% of Retiree a nd covered s pous e or

premi ums , not to

7/1/2006

Prior to

i

f

Classified 30 Any exceed the ma ximum College child(ren), any

On or 15 58 payment for active employees Reti ree only

after 7/1/2006

(by covera ge level) i n effect at

Prior to 10 55 Retiree plus covered s pous e

6/30/2000

after 6/30/2000, but

On or the time of retirement.

f

Faculty 15 55 and/or other dependents, i any

before 10/1/2007

r

o

On after 10/1/2007 15 55 The reti ree pa ys for a l l Reti ree only

subsequent i ncreases i n

Management/ Pri or 9/1/2003 15 55 excess of Reti ree onl y, except s pous e

to

the maximums in

Administrative/ effect at the time of his or her benefi ts are provided for 2 years

r

o

Exempt On after 9/1/2003 15 62 reti rement. Reti ree only

57