Page 68 - 2019-20 CAFR

P. 68

Rogue Community College

Notes to Basic Financial Statements

Year ended June 30, 2020

8. Pension Plans (continued)

Discount Rate

The discount rate used to measure the total pension liability was 7.2% for the Defined Benefit Pension

Plan. The projection of cash flows used to determine the discount rate assumed that contributions

from plan members and those of the contributing employers are made at the contractually required

rates, as actuarially determined. Based on those assumptions, the Plan’s fiduciary net position was

projected to be available to make all projected future benefit payments of current Plan members.

Therefore, the long‐term expected rate of return on Plan investments for the Defined Benefit Plan

was applied to all periods of projected benefit payments to determine the total pension liability.

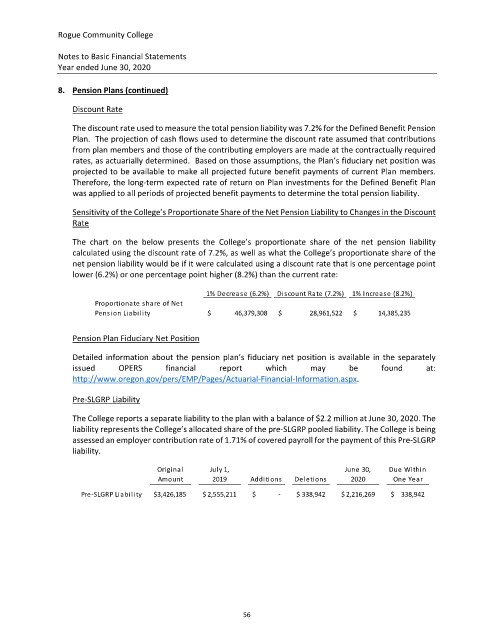

Sensitivity of the College’s Proportionate Share of the Net Pension Liability to Changes in the Discount

Rate

The chart on the below presents the College’s proportionate share of the net pension liability

calculated using the discount rate of 7.2%, as well as what the College’s proportionate share of the

net pension liability would be if it were calculated using a discount rate that is one percentage point

lower (6.2%) or one percentage point higher (8.2%) than the current rate:

1% Decrease (6.2%) Discount Rate (7.2%) 1% Increase (8.2%)

Proportionate share of Net

Pension Liability $ 46,379,308 $ 28,961,522 $ 14,385,235

Pension Plan Fiduciary Net Position

Detailed information about the pension plan’s fiduciary net position is available in the separately

s s u e d i P E R S O f i n a n c i a l r e p o r t w h i c h m a y b e f o u n d a t :

http://www.oregon.gov/pers/EMP/Pages/Actuarial‐Financial‐Information.aspx.

Pre‐SLGRP Liability

The College reports a separate liability to the plan with a balance of $2.2 million at June 30, 2020. The

liability represents the College’s allocated share of the pre‐SLGRP pooled liability. The College is being

assessed an employer contribution rate of 1.71% of covered payroll for the payment of this Pre‐SLGRP

liability.

Original Jul y 1, June 30, Due Within

Amount 2019 Addi ti ons Deletions 2020 One Year

Pre‐SLGRP Liability $3,426,185 $ 2,555,211 $ ‐ $ 338,942 $ 2,216,269 $ 338,942

56