Page 65 - 2019-20 CAFR

P. 65

Rogue Community College

Notes to Basic Financial Statements

Year ended June 30, 2020

8. Pension Plans (continued)

Pension Liability, Pension Expense, and Deferred Outflow of Resources and Deferred Inflow of

Resources Related to Pensions (continued)

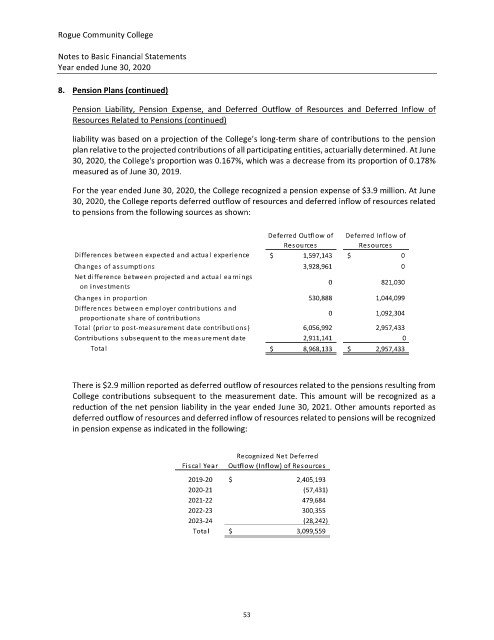

liability was based on a projection of the College’s long‐term share of contributions to the pension

plan relative to the projected contributions of all participating entities, actuarially determined. At June

30, 2020, the College's proportion was 0.167%, which was a decrease from its proportion of 0.178%

measured as of June 30, 2019.

For the year ended June 30, 2020, the College recognized a pension expense of $3.9 million. At June

30, 2020, the College reports deferred outflow of resources and deferred inflow of resources related

to pensions from the following sources as shown:

Deferred Outflow of Deferred Inflow of

Resources Resources

Differences between expected and actua l experi ence $ 1,597,143 $ 0

Changes of assumptions 3,928,961 0

Net difference between projected and actual earnings

0 821,030

on investments

Cha nges i n 530,888 1,044,099

proporti on

Differences between employer contributions and

0 1,092,304

proportionate s hare of contributions

Tota l (pri or to pos t‐mea s urement da te contributi ons ) 6,056,992 2,957,433

Contri butions subsequent to the meas urement da te 2,911,141 0

Tota l $ 8,968,133 $ 2,957,433

There is $2.9 million reported as deferred outflow of resources related to the pensions resulting from

College contributions subsequent to the measurement date. This amount will be recognized as a

reduction of the net pension liability in the year ended June 30, 2021. Other amounts reported as

deferred outflow of resources and deferred inflow of resources related to pensions will be recognized

in pension expense as indicated in the following:

Recognized Net Deferred

Fisca l Year Outflow (Inflow) of Resources

2019‐20 $ 2,405,193

2020‐21 (57,431)

2021‐22 479,684

2022‐23 300,355

2023‐24 (28,242)

Total $ 3,099,559

53