Page 86 - Combined file Solheim

P. 86

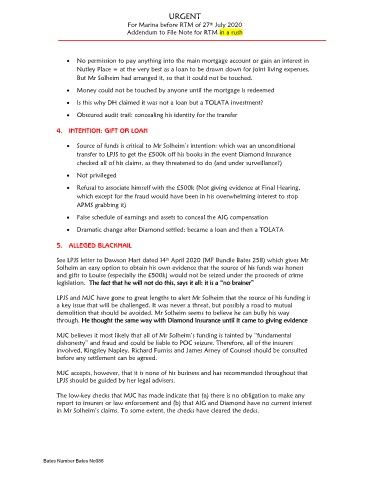

URGENT

For Marina before RTM of 27 July 2020

th

Addendum to File Note for RTM in a rush

No permission to pay anything into the main mortgage account or gain an interest in

Nutley Place = at the very best as a loan to be drawn down for joint living expenses.

But Mr Solheim had arranged it, so that it could not be touched.

Money could not be touched by anyone until the mortgage is redeemed

Is this why DH claimed it was not a loan but a TOLATA investment?

Obscured audit trail: concealing his identity for the transfer

4. INTENTION: GIFT OR LOAN

Source of funds is critical to Mr Solheim’s intention: which was an unconditional

transfer to LPJS to get the £500k off his books in the event Diamond Insurance

checked all of his claims, as they threatened to do (and under surveillance?)

Not privileged

Refusal to associate himself with the £500k (Not giving evidence at Final Hearing,

which except for the fraud would have been in his overwhelming interest to stop

APMS grabbing it)

False schedule of earnings and assets to conceal the AIG compensation

Dramatic change after Diamond settled: became a loan and then a TOLATA

5. ALLEGED BLACKMAIL

See LPJS letter to Dawson Hart dated 14 April 2020 (MF Bundle Bates 258) which gives Mr

th

Solheim an easy option to obtain his own evidence that the source of his funds was honest

and gifts to Louise (especially the £500k) would not be seized under the proceeds of crime

legislation. The fact that he will not do this, says it all: it is a “no brainer”

LPJS and MJC have gone to great lengths to alert Mr Solheim that the source of his funding is

a key issue that will be challenged. It was never a threat, but possibly a road to mutual

demolition that should be avoided. Mr Solheim seems to believe he can bully his way

through. He thought the same way with Diamond Insurance until it came to giving evidence

MJC believes it most likely that all of Mr Solheim’s funding is tainted by “fundamental

dishonesty” and fraud and could be liable to POC seizure. Therefore, all of the insurers

involved, Kingsley Napley, Richard Furniss and James Arney of Counsel should be consulted

before any settlement can be agreed.

MJC accepts, however, that it is none of his business and has recommended throughout that

LPJS should be guided by her legal advisers.

The low-key checks that MJC has made indicate that (a) there is no obligation to make any

report to insurers or law enforcement and (b) that AIG and Diamond have no current interest

in Mr Solheim’s claims. To some extent, the checks have cleared the decks.

Bates Number Bates No086