Page 47 - Inegrated Annual Report 2020-Eng

P. 47

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS | 31 DECEMBER 2020

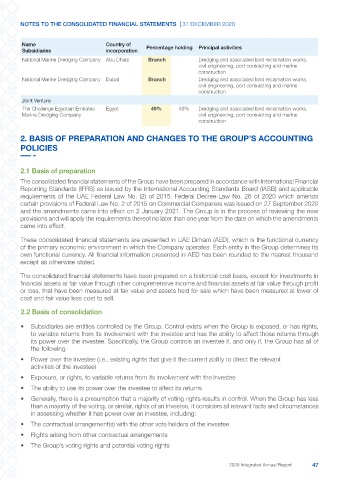

Name Country of Percentage holding Principal activities

Subsidiaries incorporation

National Marine Dredging Company Abu Dhabi Branch Dredging and associated land reclamation works,

civil engineering, port contracting and marine

construction

National Marine Dredging Company Dubai Branch Dredging and associated land reclamation works,

civil engineering, port contracting and marine

construction

Joint Venture

The Challenge Egyptian Emirates Egypt 49% 49% Dredging and associated land reclamation works,

Marine Dredging Company civil engineering, port contracting and marine

construction

2. BASIS OF PREPARATION AND CHANGES TO THE GROUP’S ACCOUNTING

POLICIES

2.1 Basis of preparation

The consolidated financial statements of the Group have been prepared in accordance with International Financial

Reporting Standards (IFRS) as issued by the International Accounting Standards Board (IASB) and applicable

requirements of the UAE Federal Law No. (2) of 2015. Federal Decree-Law No. 26 of 2020 which amends

certain provisions of Federal Law No. 2 of 2015 on Commercial Companies was issued on 27 September 2020

and the amendments came into effect on 2 January 2021. The Group is in the process of reviewing the new

provisions and will apply the requirements thereof no later than one year from the date on which the amendments

came into effect.

These consolidated financial statements are presented in UAE Dirham (AED), which is the functional currency

of the primary economic environment in which the Company operates. Each entity in the Group determines its

own functional currency. All financial information presented in AED has been rounded to the nearest thousand

except as otherwise stated.

The consolidated financial statements have been prepared on a historical cost basis, except for investments in

financial assets at fair value through other comprehensive income and financial assets at fair value through profit

or loss, that have been measured at fair value and assets held for sale which have been measured at lower of

cost and fair value less cost to sell.

2.2 Basis of consolidation

• Subsidiaries are entities controlled by the Group. Control exists when the Group is exposed, or has rights,

to variable returns from its involvement with the investee and has the ability to affect those returns through

its power over the investee. Specifically, the Group controls an investee if, and only if, the Group has all of

the following:

• Power over the investee (i.e., existing rights that give it the current ability to direct the relevant

activities of the investee)

• Exposure, or rights, to variable returns from its involvement with the investee

• The ability to use its power over the investee to affect its returns

• Generally, there is a presumption that a majority of voting rights results in control. When the Group has less

than a majority of the voting, or similar, rights of an investee, it considers all relevant facts and circumstances

in assessing whether it has power over an investee, including:

• The contractual arrangement(s) with the other vote holders of the investee

• Rights arising from other contractual arrangements

• The Group’s voting rights and potential voting rights

2020 Integrated Annual Report 47