Page 12 - NextCare Holdings 2022 Benefits Guide

P. 12

Additional Voluntary Life Details

Should you wish to enroll in an amount greater than $150,000 for yourself or greater than $30,000 for your

spouse, you will be required to complete an evidence of insurability application.

If you decline this coverage when irst eligible, you may join at the next open enrollment period but will be

subject to completing the personal health application for any amount of coverage elected. A personal health

application will be required for any change in coverage once elected also.

Please see the NextCare Intranet beneits page for more details.

Conversion Benefit

If you are an active employee, terminated employee, retiree, or dependent who may be faced with losing all

coverage or even a portion of your coverage under NextCare’s Group life plan(s), you and/or your dependents

may be eligible to continue the lost amount of coverage without submitting evidence of good health.

You have 31 days from the date of your termination to participate in life insurance and long term disability

conversion. If your employment is terminating because you are disabled, you will need to convert your life

insurance coverage to be eligible for Waiver of Premium.

Please contact Michelle Geeve to obtain the Notice of Conversion and/or Portability Rights Form. This form

must be completed and submitted to New York Life within 91 days of the date of your coverage change.

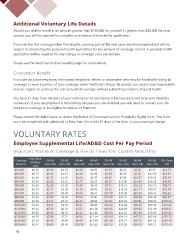

VOLUNTARY RATES

Employee Supplemental Life/AD&D Cost Per Pay Period

Important: Maximum Coverage is Five (5) Times Your Current Annual Pay

Less Than

Coverage 30 Years 30–34 35–39 40–44 45–49 50–54 55–59 60–64 65–69 70+ Years

Amount Old Years Old Years Old Years Old Years Old Years Old Years Old Years Old Years Old Old

$10,000 $0.36 $0.46 $0.56 $0.69 $0.99 $1.54 $2.63 $3.62 $6.54 $11.75

$20,000 $0.73 $0.91 $1.13 $1.38 $1.98 $3.08 $5.25 $7.25 $13.09 $23.49

$30,000 $1.09 $1.37 $1.69 $2.08 $2.96 $4.62 $7.88 $10.87 $19.63 $35.24

$40,000 $1.46 $1.83 $2.25 $2.77 $3.95 $6.17 $10.50 $14.49 $26.18 $46.98

$50,000 $1.82 $2.28 $2.82 $3.46 $4.94 $7.71 $13.13 $18.12 $32.72 $58.73

$60,000 $2.19 $2.74 $3.38 $4.15 $5.93 $9.25 $15.76 $21.74 $39.27 $70.48

$70,000 $2.55 $3.20 $3.94 $4.85 $6.91 $10.79 $18.38 $25.36 $45.81 $82.22

$80,000 $2.92 $3.66 $4.50 $5.54 $7.90 $12.33 $21.01 $28.98 $52.36 $93.97

$90,000 $3.28 $4.11 $5.07 $6.23 $8.89 $13.87 $23.64 $32.61 $58.90 $105.72

$100,000 $3.65 $4.57 $5.63 $6.92 $9.88 $15.42 $26.26 $36.23 $65.45 $117.46

$110,000 $4.01 $5.03 $6.19 $7.62 $10.86 $16.96 $28.89 $39.85 $71.99 $129.21

$120,000 $4.38 $5.48 $6.76 $8.31 $11.85 $18.50 $31.51 $43.48 $78.54 $140.95

$130,000 $4.74 $5.94 $7.32 $9.00 $12.84 $20.04 $34.14 $47.10 $85.08 $152.70

$140,000 $5.10 $6.40 $7.88 $9.69 $13.83 $21.58 $36.77 $50.72 $91.62 $164.45

$150,000 $5.47 $6.85 $8.45 $10.38 $14.82 $23.12 $39.39 $54.35 $98.17 $176.19

12

Should you wish to enroll in an amount greater than $150,000 for yourself or greater than $30,000 for your

spouse, you will be required to complete an evidence of insurability application.

If you decline this coverage when irst eligible, you may join at the next open enrollment period but will be

subject to completing the personal health application for any amount of coverage elected. A personal health

application will be required for any change in coverage once elected also.

Please see the NextCare Intranet beneits page for more details.

Conversion Benefit

If you are an active employee, terminated employee, retiree, or dependent who may be faced with losing all

coverage or even a portion of your coverage under NextCare’s Group life plan(s), you and/or your dependents

may be eligible to continue the lost amount of coverage without submitting evidence of good health.

You have 31 days from the date of your termination to participate in life insurance and long term disability

conversion. If your employment is terminating because you are disabled, you will need to convert your life

insurance coverage to be eligible for Waiver of Premium.

Please contact Michelle Geeve to obtain the Notice of Conversion and/or Portability Rights Form. This form

must be completed and submitted to New York Life within 91 days of the date of your coverage change.

VOLUNTARY RATES

Employee Supplemental Life/AD&D Cost Per Pay Period

Important: Maximum Coverage is Five (5) Times Your Current Annual Pay

Less Than

Coverage 30 Years 30–34 35–39 40–44 45–49 50–54 55–59 60–64 65–69 70+ Years

Amount Old Years Old Years Old Years Old Years Old Years Old Years Old Years Old Years Old Old

$10,000 $0.36 $0.46 $0.56 $0.69 $0.99 $1.54 $2.63 $3.62 $6.54 $11.75

$20,000 $0.73 $0.91 $1.13 $1.38 $1.98 $3.08 $5.25 $7.25 $13.09 $23.49

$30,000 $1.09 $1.37 $1.69 $2.08 $2.96 $4.62 $7.88 $10.87 $19.63 $35.24

$40,000 $1.46 $1.83 $2.25 $2.77 $3.95 $6.17 $10.50 $14.49 $26.18 $46.98

$50,000 $1.82 $2.28 $2.82 $3.46 $4.94 $7.71 $13.13 $18.12 $32.72 $58.73

$60,000 $2.19 $2.74 $3.38 $4.15 $5.93 $9.25 $15.76 $21.74 $39.27 $70.48

$70,000 $2.55 $3.20 $3.94 $4.85 $6.91 $10.79 $18.38 $25.36 $45.81 $82.22

$80,000 $2.92 $3.66 $4.50 $5.54 $7.90 $12.33 $21.01 $28.98 $52.36 $93.97

$90,000 $3.28 $4.11 $5.07 $6.23 $8.89 $13.87 $23.64 $32.61 $58.90 $105.72

$100,000 $3.65 $4.57 $5.63 $6.92 $9.88 $15.42 $26.26 $36.23 $65.45 $117.46

$110,000 $4.01 $5.03 $6.19 $7.62 $10.86 $16.96 $28.89 $39.85 $71.99 $129.21

$120,000 $4.38 $5.48 $6.76 $8.31 $11.85 $18.50 $31.51 $43.48 $78.54 $140.95

$130,000 $4.74 $5.94 $7.32 $9.00 $12.84 $20.04 $34.14 $47.10 $85.08 $152.70

$140,000 $5.10 $6.40 $7.88 $9.69 $13.83 $21.58 $36.77 $50.72 $91.62 $164.45

$150,000 $5.47 $6.85 $8.45 $10.38 $14.82 $23.12 $39.39 $54.35 $98.17 $176.19

12