Page 46 - Remote Desktop Redirected Printer Doc

P. 46

Wisconsin Health and Educational Facilities Authority

Notes to Financial Statements

June 30, 2020 and 2019

NOTE 2 CASH AND CASH EQUIVALENTS AND INVESTMENT SECURITIES (continued)

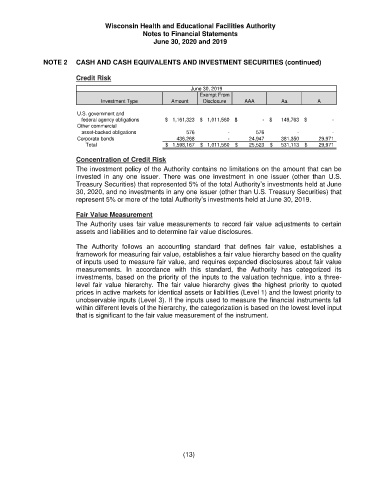

Credit Risk

June 30, 2019

Exempt From

Investment Type Amount Disclosure AAA Aa A

U.S. government and

federal agency obligations $ 1,161,323 $ 1,011,560 $ - $ 149,763 $ -

Other commercial

asset-backed obligations 576 - 576 - -

Corporate bonds 436,268 - 24,947 381,350 29,971

Total $ 1,598,167 $ 1,011,560 $ 25,523 $ 531,113 $ 29,971

Concentration of Credit Risk

The investment policy of the Authority contains no limitations on the amount that can be

invested in any one issuer. There was one investment in one issuer (other than U.S.

Treasury Securities) that represented 5% of the total Authority’s investments held at June

30, 2020, and no investments in any one issuer (other than U.S. Treasury Securities) that

represent 5% or more of the total Authority’s investments held at June 30, 2019.

Fair Value Measurement

The Authority uses fair value measurements to record fair value adjustments to certain

assets and liabilities and to determine fair value disclosures.

The Authority follows an accounting standard that defines fair value, establishes a

framework for measuring fair value, establishes a fair value hierarchy based on the quality

of inputs used to measure fair value, and requires expanded disclosures about fair value

measurements. In accordance with this standard, the Authority has categorized its

investments, based on the priority of the inputs to the valuation technique, into a three-

level fair value hierarchy. The fair value hierarchy gives the highest priority to quoted

prices in active markets for identical assets or liabilities (Level 1) and the lowest priority to

unobservable inputs (Level 3). If the inputs used to measure the financial instruments fall

within different levels of the hierarchy, the categorization is based on the lowest level input

that is significant to the fair value measurement of the instrument.

(13)