Page 51 - Remote Desktop Redirected Printer Doc

P. 51

Wisconsin Health and Educational Facilities Authority

Notes to Financial Statements

June 30, 2020 and 2019

NOTE 5 DEFINED BENEFIT PENSION PLAN (continued)

Contributions (continued)

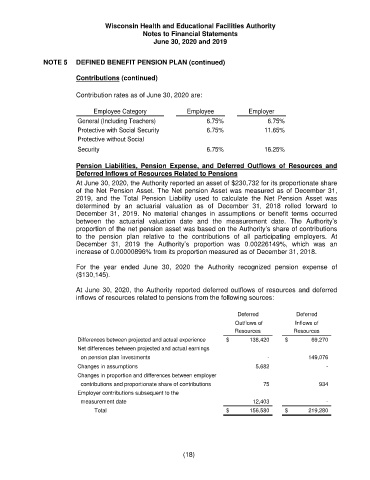

Contribution rates as of June 30, 2020 are:

Employee Category Employee Employer

General (Including Teachers) 6.75% 6.75%

Protective with Social Security 6.75% 11.65%

Protective without Social

Security 6.75% 16.25%

Pension Liabilities, Pension Expense, and Deferred Outflows of Resources and

Deferred Inflows of Resources Related to Pensions

At June 30, 2020, the Authority reported an asset of $230,732 for its proportionate share

of the Net Pension Asset. The Net pension Asset was measured as of December 31,

2019, and the Total Pension Liability used to calculate the Net Pension Asset was

determined by an actuarial valuation as of December 31, 2018 rolled forward to

December 31, 2019. No material changes in assumptions or benefit terms occurred

between the actuarial valuation date and the measurement date. The Authority’s

proportion of the net pension asset was based on the Authority’s share of contributions

to the pension plan relative to the contributions of all participating employers. At

December 31, 2019 the Authority’s proportion was 0.00226149%, which was an

increase of 0.00000896% from its proportion measured as of December 31, 2018.

For the year ended June 30, 2020 the Authority recognized pension expense of

($130,145).

At June 30, 2020, the Authority reported deferred outflows of resources and deferred

inflows of resources related to pensions from the following sources:

Deferred Deferred

Outflows of Inflows of

Resources Resources

Differences between projected and actual experience $ 138,420 $ 69,270

Net differences between projected and actual earnings

on pension plan investments - 149,076

Changes in assumptions 5,682 -

Changes in proportion and differences between employer

contributions and proportionate share of contributions 75 934

Employer contributions subsequent to the

measurement date 12,403 -

Total $ 156,580 $ 219,280

(18)