Page 53 - Remote Desktop Redirected Printer Doc

P. 53

Wisconsin Health and Educational Facilities Authority

Notes to Financial Statements

June 30, 2020 and 2019

NOTE 5 DEFINED BENEFIT PENSION PLAN (continued)

Actuarial Assumptions (continued)

Actuarial assumptions are based upon an experience study conducted in 2018 that

covered a three-year period from January 1, 2015 to December 31, 2017. The Total

Pension Liability for December 31, 2019 is based upon a roll-forward of the liability

calculated from the December 31, 2018 actuarial valuation.

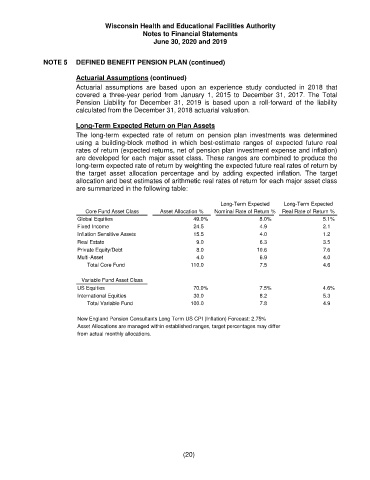

Long-Term Expected Return on Plan Assets

The long-term expected rate of return on pension plan investments was determined

using a building-block method in which best-estimate ranges of expected future real

rates of return (expected returns, net of pension plan investment expense and inflation)

are developed for each major asset class. These ranges are combined to produce the

long-term expected rate of return by weighting the expected future real rates of return by

the target asset allocation percentage and by adding expected inflation. The target

allocation and best estimates of arithmetic real rates of return for each major asset class

are summarized in the following table:

Long-Term Expected Long-Term Expected

Core Fund Asset Class Asset Allocation % Nominal Rate of Return % Real Rate of Return %

Global Equities 49.0% 8.0% 5.1%

Fixed Income 24.5 4.9 2.1

Inflation Sensitive Assets 15.5 4.0 1.2

Real Estate 9.0 6.3 3.5

Private Equity/Debt 8.0 10.6 7.6

Multi-Asset 4.0 6.9 4.0

Total Core Fund 110.0 7.5 4.6

Variable Fund Asset Class

US Equities 70.0% 7.5% 4.6%

International Equities 30.0 8.2 5.3

Total Variable Fund 100.0 7.8 4.9

New England Pension Consultants Long Term US CPI (Inflation) Forecast: 2.75%

Asset Allocations are managed within established ranges, target percentages may differ

from actual monthly allocations.

(20)