Page 452 - Microeconomics, Fourth Edition

P. 452

c10competitive markets applications.qxd 7/15/10 4:58 PM Page 426

426 CHAPTER 10 COMPETITIVE MARKETS: APPLICATIONS

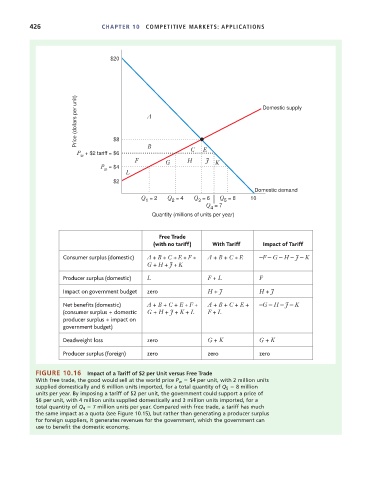

$20

Price (dollars per unit) A Domestic supply

$8

B

P + $2 tariff = $6 C E

w

F H J

G K

P = $4

w

L

$2

Domestic demand

Q = 2 Q = 4 Q = 6 Q = 8 10

1 2 3 5

Q = 7

4

Quantity (millions of units per year)

Free Trade

(with no tariff) With Tariff Impact of Tariff

Consumer surplus (domestic) A + B + C+E+F+ A + B + C+E –F – G – H – J – K

G + H + J+K

Producer surplus (domestic) L F + L F

Impact on government budget zero H + J H + J

Net benefits (domestic) A + B + C + E + F + A + B + C + E + –G – H – J – K

(consumer surplus + domestic G + H + J + K + L F + L

producer surplus + impact on

government budget)

Deadweight loss zero G + K G + K

Producer surplus (foreign) zero zero zero

FIGURE 10.16 Impact of a Tariff of $2 per Unit versus Free Trade

With free trade, the good would sell at the world price P w $4 per unit, with 2 million units

supplied domestically and 6 million units imported, for a total quantity of Q 5 8 million

units per year. By imposing a tariff of $2 per unit, the government could support a price of

$6 per unit, with 4 million units supplied domestically and 3 million units imported, for a

total quantity of Q 4 7 million units per year. Compared with free trade, a tariff has much

the same impact as a quota (see Figure 10.15), but rather than generating a producer surplus

for foreign suppliers, it generates revenues for the government, which the government can

use to benefit the domestic economy.