Page 114 - Business Principles and Management

P. 114

C HAPTER 4 A SSESSMENT

thomsonedu.com/school/bpmxtra

CHAPTER CONCEPTS

• Firms go into international business because of the potential for

larger profits and limited opportunities in the home market. Removal

of barriers to trade and investment, creation of trading blocs, and

technological advances in communication and transportation have

created a positive environment for conducting international business.

• International business occurs in various forms, such as exporting and

importing, licensing, joint ventures, wholly owned subsidiaries, strate-

gic alliances, and multinational firms.

• International business faces unique challenges, such as the need to

work within the rules set by more than one government, currency

exchange rates, and cultural differences.

• Two theories explain international trade and investments. The theory

of comparative advantage explains why a particular country special-

izes in producing a particular product or service. The product life

cycle theory explains how a product’s life stage encourages inter-

national business.

• Data on trade and investment are used to set business and economic

policies. The balance of trade between countries is evidence of a

nation’s financial strength or weakness.

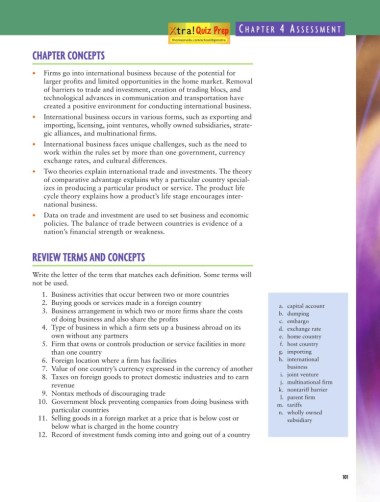

REVIEW TERMS AND CONCEPTS

Write the letter of the term that matches each definition. Some terms will

not be used.

1. Business activities that occur between two or more countries

2. Buying goods or services made in a foreign country a. capital account

3. Business arrangement in which two or more firms share the costs b. dumping

of doing business and also share the profits c. embargo

4. Type of business in which a firm sets up a business abroad on its d. exchange rate

own without any partners e. home country

5. Firm that owns or controls production or service facilities in more f. host country

than one country g. importing

6. Foreign location where a firm has facilities h. international

7. Value of one country’s currency expressed in the currency of another business

8. Taxes on foreign goods to protect domestic industries and to earn i. joint venture

revenue j. multinational firm

9. Nontax methods of discouraging trade k. nontariff barrier

l. parent firm

10. Government block preventing companies from doing business with m. tariffs

particular countries n. wholly owned

11. Selling goods in a foreign market at a price that is below cost or subsidiary

below what is charged in the home country

12. Record of investment funds coming into and going out of a country

101