Page 154 - Business Principles and Management

P. 154

Chapter 6 • Corporate Forms of Business Ownership

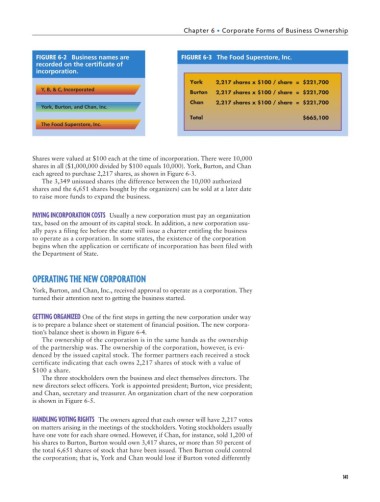

FIGURE 6-2 Business names are FIGURE 6-3 The Food Superstore, Inc.

recorded on the certificate of

incorporation.

York 2,217 shares x $100 / share = $221,700

Y, B, & C, Incorporated

Burton 2,217 shares x $100 / share = $221,700

Chan 2,217 shares x $100 / share = $221,700

York, Burton, and Chan, Inc.

Total $665,100

The Food Superstore, Inc.

Shares were valued at $100 each at the time of incorporation. There were 10,000

shares in all ($1,000,000 divided by $100 equals 10,000). York, Burton, and Chan

each agreed to purchase 2,217 shares, as shown in Figure 6-3.

The 3,349 unissued shares (the difference between the 10,000 authorized

shares and the 6,651 shares bought by the organizers) can be sold at a later date

to raise more funds to expand the business.

PAYING INCORPORATION COSTS Usually a new corporation must pay an organization

tax, based on the amount of its capital stock. In addition, a new corporation usu-

ally pays a filing fee before the state will issue a charter entitling the business

to operate as a corporation. In some states, the existence of the corporation

begins when the application or certificate of incorporation has been filed with

the Department of State.

OPERATING THE NEW CORPORATION

York, Burton, and Chan, Inc., received approval to operate as a corporation. They

turned their attention next to getting the business started.

GETTING ORGANIZED One of the first steps in getting the new corporation under way

is to prepare a balance sheet or statement of financial position. The new corpora-

tion’s balance sheet is shown in Figure 6-4.

The ownership of the corporation is in the same hands as the ownership

of the partnership was. The ownership of the corporation, however, is evi-

denced by the issued capital stock. The former partners each received a stock

certificate indicating that each owns 2,217 shares of stock with a value of

$100 a share.

The three stockholders own the business and elect themselves directors. The

new directors select officers. York is appointed president; Burton, vice president;

and Chan, secretary and treasurer. An organization chart of the new corporation

is shown in Figure 6-5.

HANDLING VOTING RIGHTS The owners agreed that each owner will have 2,217 votes

on matters arising in the meetings of the stockholders. Voting stockholders usually

have one vote for each share owned. However, if Chan, for instance, sold 1,200 of

his shares to Burton, Burton would own 3,417 shares, or more than 50 percent of

the total 6,651 shares of stock that have been issued. Then Burton could control

the corporation; that is, York and Chan would lose if Burton voted differently

141