Page 168 - Business Principles and Management

P. 168

C HAPTER 6 A SSESSMENT

thomsonedu.com/school/bpmxtra

CHAPTER CONCEPTS

• A corporation is a form of ownership preferred by large and growing

firms. Corporations are more difficult to form than sole proprietor-

ships or partnerships. A business must specify its purpose, identify its

owners (stockholders), elect a board of directors, select officers, estab-

lish operating policies, and prepare a charter for approval by the state.

• The chief advantages of corporations are that liability is limited, more

capital can be raised for growth, stock can be bought and sold more

easily than ownership shares in partnerships, and the life of the corpo-

ration does not end when owners sell their shares.

• The chief disadvantages of corporations include higher tax rates, double

taxation, and more extensive record keeping and government-required

paperwork.

• Joint ventures are alliances formed among companies to produce a

product or service that neither alone could provide efficiently. A virtual

corporation is a type of joint venture in which a network of companies

form temporary alliances among themselves as needed to take advan-

tage of current market conditions. Cooperatives, such as credit unions,

are businesses owned and operated by their user-members for the pur-

pose of supplying themselves with goods and services.

• Limited liability companies (LLC) and Subchapter S corporations

avoid double taxation and the unlimited-liability disadvantage of

partnerships. Nonprofit corporations do not pay taxes and do not

exist to make a profit. Quasi-public corporations are important to

society but are government-run because they lack the profit poten-

tial to attract private investors.

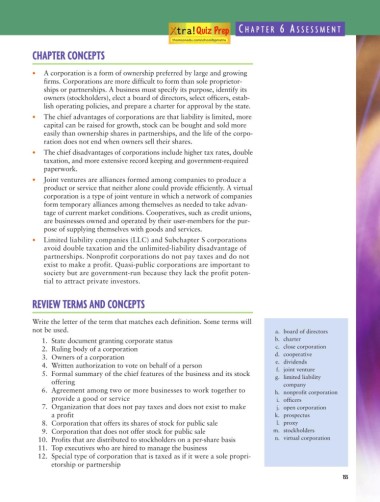

REVIEW TERMS AND CONCEPTS

Write the letter of the term that matches each definition. Some terms will

not be used. a. board of directors

1. State document granting corporate status b. charter

2. Ruling body of a corporation c. close corporation

3. Owners of a corporation d. cooperative

4. Written authorization to vote on behalf of a person e. dividends

f. joint venture

5. Formal summary of the chief features of the business and its stock g. limited liability

offering company

6. Agreement among two or more businesses to work together to h. nonprofit corporation

provide a good or service i. officers

7. Organization that does not pay taxes and does not exist to make j. open corporation

a profit k. prospectus

8. Corporation that offers its shares of stock for public sale l. proxy

9. Corporation that does not offer stock for public sale m. stockholders

10. Profits that are distributed to stockholders on a per-share basis n. virtual corporation

11. Top executives who are hired to manage the business

12. Special type of corporation that is taxed as if it were a sole propri-

etorship or partnership

155