Page 404 - Business Principles and Management

P. 404

Chapter 15 • Business Financial Records

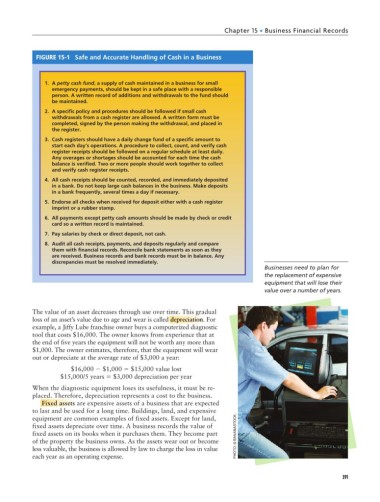

FIGURE 15-1 Safe and Accurate Handling of Cash in a Business

1. A petty cash fund, a supply of cash maintained in a business for small

emergency payments, should be kept in a safe place with a responsible

person. A written record of additions and withdrawals to the fund should

be maintained.

2. A specific policy and procedures should be followed if small cash

withdrawals from a cash register are allowed. A written form must be

completed, signed by the person making the withdrawal, and placed in

the register.

3. Cash registers should have a daily change fund of a specific amount to

start each day’s operations. A procedure to collect, count, and verify cash

register receipts should be followed on a regular schedule at least daily.

Any overages or shortages should be accounted for each time the cash

balance is verified. Two or more people should work together to collect

and verify cash register receipts.

4. All cash receipts should be counted, recorded, and immediately deposited

in a bank. Do not keep large cash balances in the business. Make deposits

in a bank frequently, several times a day if necessary.

5. Endorse all checks when received for deposit either with a cash register

imprint or a rubber stamp.

6. All payments except petty cash amounts should be made by check or credit

card so a written record is maintained.

7. Pay salaries by check or direct deposit, not cash.

8. Audit all cash receipts, payments, and deposits regularly and compare

them with financial records. Reconcile bank statements as soon as they

are received. Business records and bank records must be in balance. Any

discrepancies must be resolved immediately.

Businesses need to plan for

the replacement of expensive

equipment that will lose their

value over a number of years.

The value of an asset decreases through use over time. This gradual

loss of an asset’s value due to age and wear is called depreciation. For

example, a Jiffy Lube franchise owner buys a computerized diagnostic

tool that costs $16,000. The owner knows from experience that at

the end of five years the equipment will not be worth any more than

$1,000. The owner estimates, therefore, that the equipment will wear

out or depreciate at the average rate of $3,000 a year:

$16,000 $1,000 $15,000 value lost

$15,000/5 years $3,000 depreciation per year

When the diagnostic equipment loses its usefulness, it must be re-

placed. Therefore, depreciation represents a cost to the business.

Fixed assets are expensive assets of a business that are expected

to last and be used for a long time. Buildings, land, and expensive

equipment are common examples of fixed assets. Except for land,

fixed assets depreciate over time. A business records the value of

fixed assets on its books when it purchases them. They become part PHOTO: © BANANASTOCK.

of the property the business owns. As the assets wear out or become

less valuable, the business is allowed by law to charge the loss in value

each year as an operating expense.

391