Page 429 - Business Principles and Management

P. 429

C HAPTER 15 A SSESSMENT

MAKE CONNECTIONS

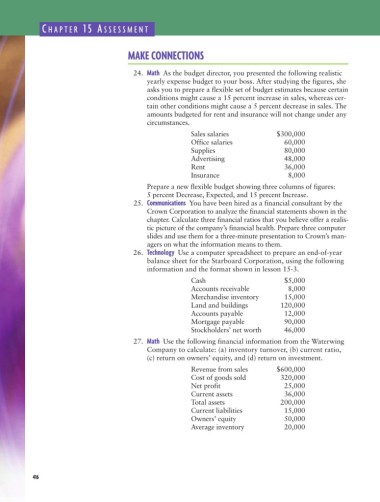

24. Math As the budget director, you presented the following realistic

yearly expense budget to your boss. After studying the figures, she

asks you to prepare a flexible set of budget estimates because certain

conditions might cause a 15 percent increase in sales, whereas cer-

tain other conditions might cause a 5 percent decrease in sales. The

amounts budgeted for rent and insurance will not change under any

circumstances.

Sales salaries $300,000

Office salaries 60,000

Supplies 80,000

Advertising 48,000

Rent 36,000

Insurance 8,000

Prepare a new flexible budget showing three columns of figures:

5 percent Decrease, Expected, and 15 percent Increase.

25. Communications You have been hired as a financial consultant by the

Crown Corporation to analyze the financial statements shown in the

chapter. Calculate three financial ratios that you believe offer a realis-

tic picture of the company’s financial health. Prepare three computer

slides and use them for a three-minute presentation to Crown’s man-

agers on what the information means to them.

26. Technology Use a computer spreadsheet to prepare an end-of-year

balance sheet for the Starboard Corporation, using the following

information and the format shown in lesson 15-3.

Cash $5,000

Accounts receivable 8,000

Merchandise inventory 15,000

Land and buildings 120,000

Accounts payable 12,000

Mortgage payable 90,000

Stockholders’ net worth 46,000

27. Math Use the following financial information from the Waterwing

Company to calculate: (a) inventory turnover, (b) current ratio,

(c) return on owners’ equity, and (d) return on investment.

Revenue from sales $600,000

Cost of goods sold 320,000

Net profit 25,000

Current assets 36,000

Total assets 200,000

Current liabilities 15,000

Owners’ equity 50,000

Average inventory 20,000

416