Page 424 - Business Principles and Management

P. 424

Chapter 15 • Business Financial Records

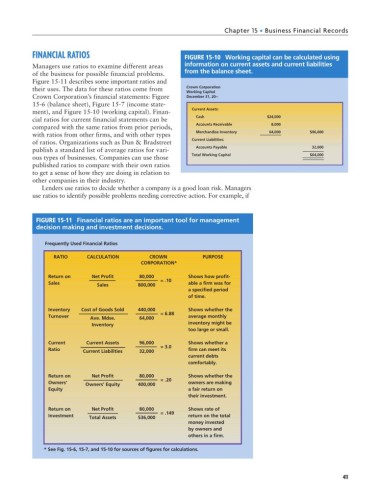

FINANCIAL RATIOS FIGURE 15-10 Working capital can be calculated using

Managers use ratios to examine different areas information on current assets and current liabilities

of the business for possible financial problems. from the balance sheet.

Figure 15-11 describes some important ratios and

their uses. The data for these ratios come from Crown Corporation

Working Capital

Crown Corporation’s financial statements: Figure December 31, 20--

15-6 (balance sheet), Figure 15-7 (income state-

ment), and Figure 15-10 (working capital). Finan- Current Assets:

cial ratios for current financial statements can be Cash $24,000

compared with the same ratios from prior periods, Accounts Receivable 8,000

with ratios from other firms, and with other types Merchandise Inventory 64,000 $96,000

of ratios. Organizations such as Dun & Bradstreet Current Liabilities:

publish a standard list of average ratios for vari- Accounts Payable 32,000

ous types of businesses. Companies can use those Total Working Capital $64,000

published ratios to compare with their own ratios

to get a sense of how they are doing in relation to

other companies in their industry.

Lenders use ratios to decide whether a company is a good loan risk. Managers

use ratios to identify possible problems needing corrective action. For example, if

FIGURE 15-11 Financial ratios are an important tool for management

decision making and investment decisions.

Frequently Used Financial Ratios

RATIO CALCULATION CROWN PURPOSE

CORPORATION*

Return on Net Profit 80,000 Shows how profit-

= .10

Sales Sales 800,000 able a firm was for

a specified period

of time.

Inventory Cost of Goods Sold 440,000 Shows whether the

Turnover Ave. Mdse. 64,000 = 6.88 average monthly

Inventory inventory might be

too large or small.

Current Current Assets 96,000 Shows whether a

= 3.0

Ratio firm can meet its

Current Liabilities 32,000

current debts

comfortably.

Return on Net Profit 80,000 Shows whether the

= .20

Owners’ Owners’ Equity 400,000 owners are making

Equity a fair return on

their investment.

Return on Net Profit 80,000 Shows rate of

= .149

Investment Total Assets 536,000 return on the total

money invested

by owners and

others in a firm.

* See Fig. 15-6, 15-7, and 15-10 for sources of figures for calculations.

411