Page 423 - Business Principles and Management

P. 423

Unit 5

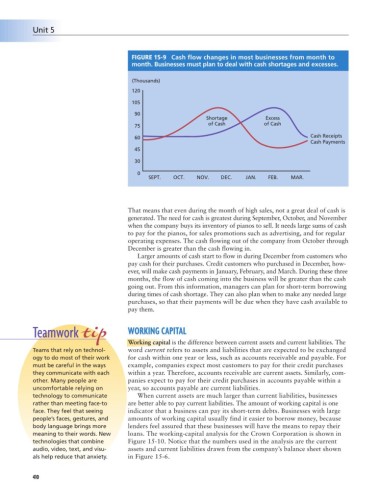

FIGURE 15-9 Cash flow changes in most businesses from month to

month. Businesses must plan to deal with cash shortages and excesses.

(Thousands)

120

105

90

Shortage Excess

75 of Cash of Cash

60 Cash Receipts

Cash Payments

45

30

0

SEPT. OCT. NOV. DEC. JAN. FEB. MAR.

That means that even during the month of high sales, not a great deal of cash is

generated. The need for cash is greatest during September, October, and November

when the company buys its inventory of pianos to sell. It needs large sums of cash

to pay for the pianos, for sales promotions such as advertising, and for regular

operating expenses. The cash flowing out of the company from October through

December is greater than the cash flowing in.

Larger amounts of cash start to flow in during December from customers who

pay cash for their purchases. Credit customers who purchased in December, how-

ever, will make cash payments in January, February, and March. During these three

months, the flow of cash coming into the business will be greater than the cash

going out. From this information, managers can plan for short-term borrowing

during times of cash shortage. They can also plan when to make any needed large

purchases, so that their payments will be due when they have cash available to

pay them.

Teamwork tip WORKING CAPITAL

Working capital is the difference between current assets and current liabilities. The

Teams that rely on technol- word current refers to assets and liabilities that are expected to be exchanged

ogy to do most of their work for cash within one year or less, such as accounts receivable and payable. For

must be careful in the ways example, companies expect most customers to pay for their credit purchases

they communicate with each within a year. Therefore, accounts receivable are current assets. Similarly, com-

other. Many people are panies expect to pay for their credit purchases in accounts payable within a

uncomfortable relying on year, so accounts payable are current liabilities.

technology to communicate When current assets are much larger than current liabilities, businesses

rather than meeting face-to are better able to pay current liabilities. The amount of working capital is one

face. They feel that seeing indicator that a business can pay its short-term debts. Businesses with large

people’s faces, gestures, and amounts of working capital usually find it easier to borrow money, because

body language brings more lenders feel assured that these businesses will have the means to repay their

meaning to their words. New loans. The working-capital analysis for the Crown Corporation is shown in

technologies that combine Figure 15-10. Notice that the numbers used in the analysis are the current

audio, video, text, and visu- assets and current liabilities drawn from the company’s balance sheet shown

als help reduce that anxiety. in Figure 15-6.

410