Page 419 - Business Principles and Management

P. 419

Unit 5

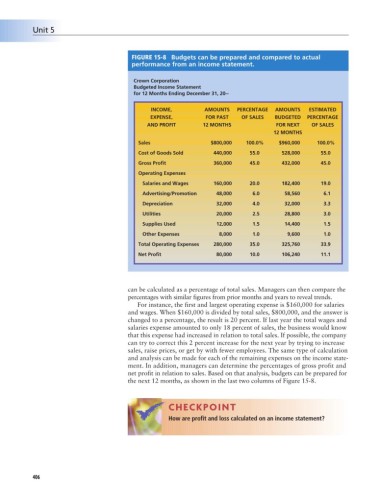

FIGURE 15-8 Budgets can be prepared and compared to actual

performance from an income statement.

Crown Corporation

Budgeted Income Statement

for 12 Months Ending December 31, 20--

INCOME, AMOUNTS PERCENTAGE AMOUNTS ESTIMATED

EXPENSE, FOR PAST OF SALES BUDGETED PERCENTAGE

AND PROFIT 12 MONTHS FOR NEXT OF SALES

12 MONTHS

Sales $800,000 100.0% $960,000 100.0%

Cost of Goods Sold 440,000 55.0 528,000 55.0

Gross Profit 360,000 45.0 432,000 45.0

Operating Expenses

Salaries and Wages 160,000 20.0 182,400 19.0

Advertising/Promotion 48,000 6.0 58,560 6.1

Depreciation 32,000 4.0 32,000 3.3

Utilities 20,000 2.5 28,800 3.0

Supplies Used 12,000 1.5 14,400 1.5

Other Expenses 8,000 1.0 9,600 1.0

Total Operating Expenses 280,000 35.0 325,760 33.9

Net Profit 80,000 10.0 106,240 11.1

can be calculated as a percentage of total sales. Managers can then compare the

percentages with similar figures from prior months and years to reveal trends.

For instance, the first and largest operating expense is $160,000 for salaries

and wages. When $160,000 is divided by total sales, $800,000, and the answer is

changed to a percentage, the result is 20 percent. If last year the total wages and

salaries expense amounted to only 18 percent of sales, the business would know

that this expense had increased in relation to total sales. If possible, the company

can try to correct this 2 percent increase for the next year by trying to increase

sales, raise prices, or get by with fewer employees. The same type of calculation

and analysis can be made for each of the remaining expenses on the income state-

ment. In addition, managers can determine the percentages of gross profit and

net profit in relation to sales. Based on that analysis, budgets can be prepared for

the next 12 months, as shown in the last two columns of Figure 15-8.

CHECKPOINT

How are profit and loss calculated on an income statement?

406