Page 418 - Business Principles and Management

P. 418

Chapter 15 • Business Financial Records

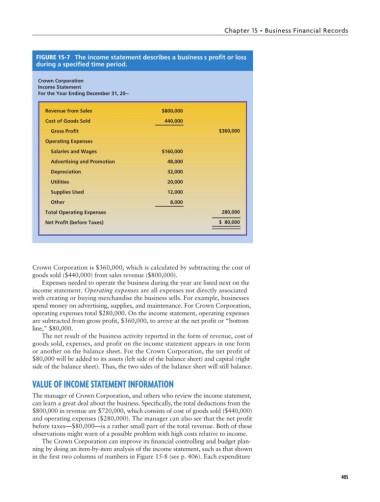

FIGURE 15-7 The income statement describes a businessÕ s profit or loss

during a specified time period.

Crown Corporation

Income Statement

For the Year Ending December 31, 20--

Revenue from Sales $800,000

Cost of Goods Sold 440,000

Gross Profit $360,000

Operating Expenses

Salaries and Wages $160,000

Advertising and Promotion 48,000

Depreciation 32,000

Utilities 20,000

Supplies Used 12,000

Other 8,000

Total Operating Expenses 280,000

Net Profit (before Taxes) $ 80,000

Crown Corporation is $360,000, which is calculated by subtracting the cost of

goods sold ($440,000) from sales revenue ($800,000).

Expenses needed to operate the business during the year are listed next on the

income statement. Operating expenses are all expenses not directly associated

with creating or buying merchandise the business sells. For example, businesses

spend money on advertising, supplies, and maintenance. For Crown Corporation,

operating expenses total $280,000. On the income statement, operating expenses

are subtracted from gross profit, $360,000, to arrive at the net profit or “bottom

line,” $80,000.

The net result of the business activity reported in the form of revenue, cost of

goods sold, expenses, and profit on the income statement appears in one form

or another on the balance sheet. For the Crown Corporation, the net profit of

$80,000 will be added to its assets (left side of the balance sheet) and capital (right

side of the balance sheet). Thus, the two sides of the balance sheet will still balance.

VALUE OF INCOME STATEMENT INFORMATION

The manager of Crown Corporation, and others who review the income statement,

can learn a great deal about the business. Specifically, the total deductions from the

$800,000 in revenue are $720,000, which consists of cost of goods sold ($440,000)

and operating expenses ($280,000). The manager can also see that the net profit

before taxes—$80,000—is a rather small part of the total revenue. Both of these

observations might warn of a possible problem with high costs relative to income.

The Crown Corporation can improve its financial controlling and budget plan-

ning by doing an item-by-item analysis of the income statement, such as that shown

in the first two columns of numbers in Figure 15-8 (see p. 406). Each expenditure

405