Page 415 - Business Principles and Management

P. 415

Unit 5

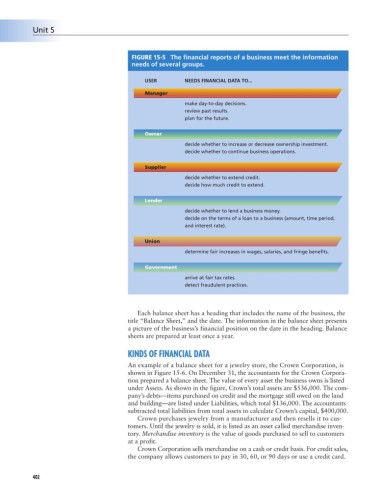

FIGURE 15-5 The financial reports of a business meet the information

needs of several groups.

USER NEEDS FINANCIAL DATA TO...

Manager

make day-to-day decisions.

review past results.

plan for the future.

Owner

decide whether to increase or decrease ownership investment.

decide whether to continue business operations.

Supplier

decide whether to extend credit.

decide how much credit to extend.

Lender

decide whether to lend a business money.

decide on the terms of a loan to a business (amount, time period,

and interest rate).

Union

determine fair increases in wages, salaries, and fringe benefits.

Government

arrive at fair tax rates.

detect fraudulent practices.

Each balance sheet has a heading that includes the name of the business, the

title “Balance Sheet,” and the date. The information in the balance sheet presents

a picture of the business’s financial position on the date in the heading. Balance

sheets are prepared at least once a year.

KINDS OF FINANCIAL DATA

An example of a balance sheet for a jewelry store, the Crown Corporation, is

shown in Figure 15-6. On December 31, the accountants for the Crown Corpora-

tion prepared a balance sheet. The value of every asset the business owns is listed

under Assets. As shown in the figure, Crown’s total assets are $536,000. The com-

pany’s debts—items purchased on credit and the mortgage still owed on the land

and building—are listed under Liabilities, which total $136,000. The accountants

subtracted total liabilities from total assets to calculate Crown’s capital, $400,000.

Crown purchases jewelry from a manufacturer and then resells it to cus-

tomers. Until the jewelry is sold, it is listed as an asset called merchandise inven-

tory. Merchandise inventory is the value of goods purchased to sell to customers

at a profit.

Crown Corporation sells merchandise on a cash or credit basis. For credit sales,

the company allows customers to pay in 30, 60, or 90 days or use a credit card.

402