Page 410 - Business Principles and Management

P. 410

Chapter 15 • Business Financial Records

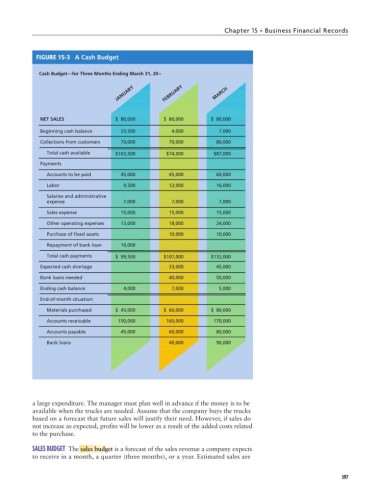

FIGURE 15-3 A Cash Budget

Cash Budget—for Three Months Ending March 31, 20--

JANUARY FEBRUARY MARCH

NET SALES $ 80,000 $ 80,000 $ 80,000

Beginning cash balance 33,500 4,000 7,000

Collections from customers 70,000 70,000 80,000

Total cash available $103,500 $74,000 $87,000

Payments

Accounts to be paid 45,000 45,000 60,000

Labor 9,500 12,000 16,000

Salaries and administrative

expense 7,000 7,000 7,000

Sales expense 15,000 15,000 15,000

Other operating expenses 13,000 18,000 24,000

Purchase of fixed assets 10,000 10,000

Repayment of bank loan 10,000

Total cash payments $ 99,500 $107,000 $132,000

Expected cash shortage 33,000 45,000

Bank loans needed 40,000 50,000

Ending cash balance 4,000 7,000 5,000

End-of-month situation:

Materials purchased $ 45,000 $ 60,000 $ 80,000

Accounts receivable 150,000 160,000 170,000

Accounts payable 45,000 60,000 80,000

Bank loans 40,000 90,000

a large expenditure. The manager must plan well in advance if the money is to be

available when the trucks are needed. Assume that the company buys the trucks

based on a forecast that future sales will justify their need. However, if sales do

not increase as expected, profits will be lower as a result of the added costs related

to the purchase.

SALES BUDGET The sales budget is a forecast of the sales revenue a company expects

to receive in a month, a quarter (three months), or a year. Estimated sales are

397