Page 416 - Business Principles and Management

P. 416

Chapter 15 • Business Financial Records

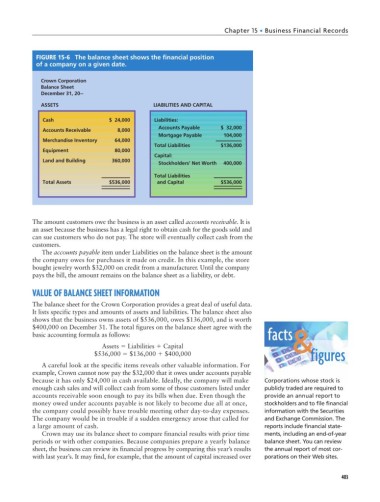

FIGURE 15-6 The balance sheet shows the financial position

of a company on a given date.

Crown Corporation

Balance Sheet

December 31, 20--

ASSETS LIABILITIES AND CAPITAL

Cash $ 24,000 Liabilities:

Accounts Payable $ 32,000

Accounts Receivable 8,000

Mortgage Payable 104,000

Merchandise Inventory 64,000

Total Liabilities $136,000

Equipment 80,000

Capital:

Land and Building 360,000

Stockholders’ Net Worth 400,000

Total Liabilities

Total Assets $536,000 and Capital $536,000

The amount customers owe the business is an asset called accounts receivable. It is

an asset because the business has a legal right to obtain cash for the goods sold and

can sue customers who do not pay. The store will eventually collect cash from the

customers.

The accounts payable item under Liabilities on the balance sheet is the amount

the company owes for purchases it made on credit. In this example, the store

bought jewelry worth $32,000 on credit from a manufacturer. Until the company

pays the bill, the amount remains on the balance sheet as a liability, or debt.

VALUE OF BALANCE SHEET INFORMATION

The balance sheet for the Crown Corporation provides a great deal of useful data.

It lists specific types and amounts of assets and liabilities. The balance sheet also

shows that the business owns assets of $536,000, owes $136,000, and is worth

$400,000 on December 31. The total figures on the balance sheet agree with the

basic accounting formula as follows: facts &

Assets Liabilities Capital

$536,000 $136,000 $400,000 figures

A careful look at the specific items reveals other valuable information. For

example, Crown cannot now pay the $32,000 that it owes under accounts payable

because it has only $24,000 in cash available. Ideally, the company will make Corporations whose stock is

enough cash sales and will collect cash from some of those customers listed under publicly traded are required to

accounts receivable soon enough to pay its bills when due. Even though the provide an annual report to

money owed under accounts payable is not likely to become due all at once, stockholders and to file financial

the company could possibly have trouble meeting other day-to-day expenses. information with the Securities

The company would be in trouble if a sudden emergency arose that called for and Exchange Commission. The

a large amount of cash. reports include financial state-

Crown may use its balance sheet to compare financial results with prior time ments, including an end-of-year

periods or with other companies. Because companies prepare a yearly balance balance sheet. You can review

sheet, the business can review its financial progress by comparing this year’s results the annual report of most cor-

with last year’s. It may find, for example, that the amount of capital increased over porations on their Web sites.

403