Page 514 - Business Principles and Management

P. 514

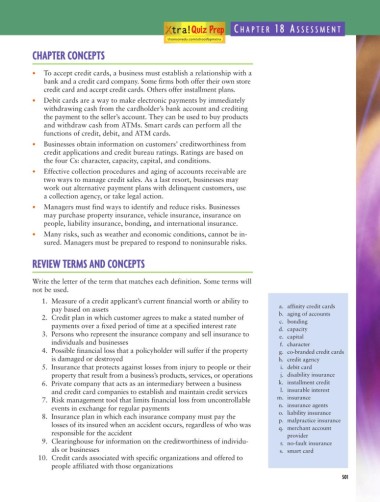

C HAPTER 18 A SSESSMENT

thomsonedu.com/school/bpmxtra

CHAPTER CONCEPTS

• To accept credit cards, a business must establish a relationship with a

bank and a credit card company. Some firms both offer their own store

credit card and accept credit cards. Others offer installment plans.

• Debit cards are a way to make electronic payments by immediately

withdrawing cash from the cardholder’s bank account and crediting

the payment to the seller’s account. They can be used to buy products

and withdraw cash from ATMs. Smart cards can perform all the

functions of credit, debit, and ATM cards.

• Businesses obtain information on customers’ creditworthiness from

credit applications and credit bureau ratings. Ratings are based on

the four Cs: character, capacity, capital, and conditions.

• Effective collection procedures and aging of accounts receivable are

two ways to manage credit sales. As a last resort, businesses may

work out alternative payment plans with delinquent customers, use

a collection agency, or take legal action.

• Managers must find ways to identify and reduce risks. Businesses

may purchase property insurance, vehicle insurance, insurance on

people, liability insurance, bonding, and international insurance.

• Many risks, such as weather and economic conditions, cannot be in-

sured. Managers must be prepared to respond to noninsurable risks.

REVIEW TERMS AND CONCEPTS

Write the letter of the term that matches each definition. Some terms will

not be used.

1. Measure of a credit applicant’s current financial worth or ability to

a. affinity credit cards

pay based on assets

b. aging of accounts

2. Credit plan in which customer agrees to make a stated number of

c. bonding

payments over a fixed period of time at a specified interest rate

d. capacity

3. Persons who represent the insurance company and sell insurance to

e. capital

individuals and businesses f. character

4. Possible financial loss that a policyholder will suffer if the property g. co-branded credit cards

is damaged or destroyed h. credit agency

5. Insurance that protects against losses from injury to people or their i. debit card

property that result from a business’s products, services, or operations j. disability insurance

6. Private company that acts as an intermediary between a business k. installment credit

and credit card companies to establish and maintain credit services l. insurable interest

7. Risk management tool that limits financial loss from uncontrollable m. insurance

n. insurance agents

events in exchange for regular payments

o. liability insurance

8. Insurance plan in which each insurance company must pay the

p. malpractice insurance

losses of its insured when an accident occurs, regardless of who was

q. merchant account

responsible for the accident

provider

9. Clearinghouse for information on the creditworthiness of individu- r. no-fault insurance

als or businesses s. smart card

10. Credit cards associated with specific organizations and offered to

people affiliated with those organizations

501