Page 450 - Introduction to Business

P. 450

424 PART 4 Accounting

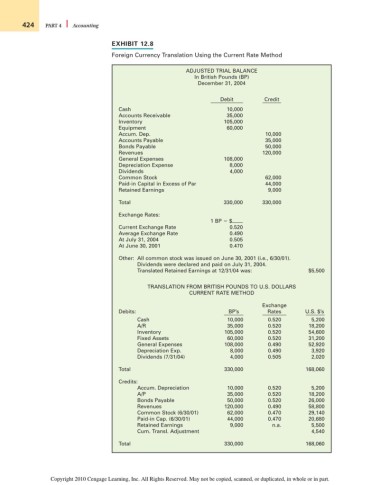

EXHIBIT 12.8

Foreign Currency Translation Using the Current Rate Method

ADJUSTED TRIAL BALANCE

In British Pounds (BP)

December 31, 2004

Debit Credit

Cash 10,000

Accounts Receivable 35,000

Inventory 105,000

Equipment 60,000

Accum. Dep. 10,000

Accounts Payable 35,000

Bonds Payable 50,000

Revenues 120,000

General Expenses 108,000

Depreciation Expense 8,000

Dividends 4,000

Common Stock 62,000

Paid-in Capital in Excess of Par 44,000

Retained Earnings 9,000

Total 330,000 330,000

Exchange Rates:

1 BP $

Current Exchange Rate 0.520

Average Exchange Rate 0.490

At July 31, 2004 0.505

At June 30, 2001 0.470

Other: All common stock was issued on June 30, 2001 (i.e., 6/30/01).

Dividends were declared and paid on July 31, 2004.

Translated Retained Earnings at 12/31/04 was: $5,500

TRANSLATION FROM BRITISH POUNDS TO U.S. DOLLARS

CURRENT RATE METHOD

Exchange

Debits: BP’s Rates U.S. $’s

Cash 10,000 0.520 5,200

A/R 35,000 0.520 18,200

Inventory 105,000 0.520 54,600

Fixed Assets 60,000 0.520 31,200

General Expenses 108,000 0.490 52,920

Depreciation Exp. 8,000 0.490 3,920

Dividends (7/31/04) 4,000 0.505 2,020

Total 330,000 168,060

Credits:

Accum. Depreciation 10,000 0.520 5,200

A/P 35,000 0.520 18,200

Bonds Payable 50,000 0.520 26,000

Revenues 120,000 0.490 58,800

Common Stock (6/30/01) 62,000 0.470 29,140

Paid-in Cap. (6/30/01) 44,000 0.470 20,680

Retained Earnings 9,000 n.a. 5,500

Cum. Transl. Adjustment 4,540

Total 330,000 168,060

Copyright 2010 Cengage Learning, Inc. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part.