Page 92 - 2021-2022 New Hire Benefits

P. 92

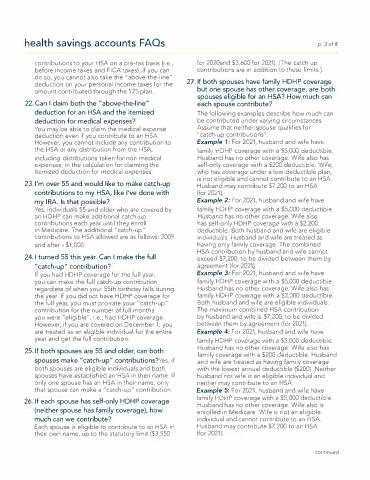

health savings accounts FAQs p. 3 of 8

contributions to your HSA on a pre-tax basis (i.e., for 2020 $3,600 for 20 catch up

before income taxes and FICA taxes). If you can contributions are in addition to these limits.)

do so, you cannot also take the "above-the-line"

deduction on your personal income taxes for the 27. If both spouses have family HDHP coverage

amount contributed through the 125 plan. but one spouse has other coverage, are both

spouses eligible for an HSA? How much can

22. Can I both the "above-the-line" each spouse contribute?

deduction for an HSA and the itemized The following examples describe how much can

deduction for me expenses? be contributed under varying circumstances.

Y may be able to claim the medical expense Assume that neither spouse qualifies for

d even if you contri an HSA. "catch-up contributions".

However, you cannot include any contribution to Exam p le 1: For 2021, husband an wif have

the HSA or distribution from HSA, H coverage w $5, deductible.

inc d taken f non-medical Husband has no other coverage. Wife also has

expenses, the calculation for claiming the s with a $200 deductible. Wife,

itemized deduction fo medical expenses. wh und a low-deductible plan,

is not eligible and cannot contribute to HSA.

23. I'm over 55 and would like to make catch-up Husband may contribute $7,200 to HSA

contributions to my HSA, like I've done with (for 2021).

my I that possible? Exam p le 2: For 2021, husband and wife have

Y individuals 55 and older are covered by family HDHP coverag with $5,0 deductible.

an HDHP can make addi catch-up Husband no other coverage. Wife also

contributions each year until they enroll has self-only HDHP coverage with a $2,200

in M The add "catch-up" d Both husband and wife ar eligible

to HSA allowed are as f 2009 individuals. Husband and wife ar treated as

and after $1,000 having only family coverage. The combined

HSA c by husband and wif cannot

24. I turned 55 this year. Can I make the full exceed $7,200, to be between them by

"catch-up" contribution? agreement (for 2021).

lf you had HDHP coverage for the full year, Exam p le 3: For 2021, husband an wife have

you can make the full catch-up contribution family coverage wit $5,000 deductible.

regardless of when your 55th birthday falls during Husband has no other coverage. Wife also has

the yea If you did not hav HDHP coverage for fa HDHP a $ deductible.

the full y you mus pro-rate yo "catch-up" Both husband and wif are eligible individuals.

contribution for the number of full months The maximum combined contribution

you were "eligible", i.e., had HDHP coverage. by husband and wife is $7,200, to be divided

Howev if you are covered on December you between them by agreement (for 2021).

are tr as a eligible individual the entire Exam p l 4: For 2021, husband and wi have

year and get the full contribution. family coverage with a $5,000 deductible.

25. If both spouses are 55 and older, can both Husband has no other coverage. Wife als has

family coverage w a $200 deduct Husband

spouses make "catch-up" contributions?Yes, if a wife are treated as having family coverage

both spouses are eligible individuals and both with the lowest annual ($2 Neither

spouses have established an HSA in their If husband wif is an eligible individual and

only one has a HSA in their name, only neither may contribute to an HSA.

that spouse can make a "catch-up" contribution. Example 2021, husband and wife have

26. If ea spouse has self-only HDHP coverage family HDHP coverage with a $5,000 deductible.

Husband has no other coverage. Wife also is

(neither spouse has family coverage), how enrolled in Medicare. Wife not an eligible

much can we contribute? individual and cannot contribute to an HSA.

Each spous is eligible to contribute to an HSA in Husband may contribute $7 ,200 to an HSA

t own name, up to t statutory lim ($3,550 (for 2021).

continued