Page 30 - 2017 INVESTMENT PHILOSOPHY - May 2017

P. 30

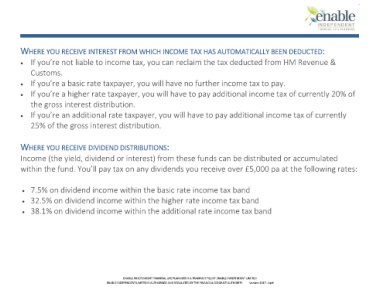

WHERE YOU RECEIVE INTEREST FROM WHICH INCOME TAX HAS AUTOMATICALLY BEEN DEDUCTED:

• If you’re not liable to income tax, you can reclaim the tax deducted from HM Revenue &

Customs.

• If you’re a basic rate taxpayer, you will have no further income tax to pay.

• If you’re a higher rate taxpayer, you will have to pay additional income tax of currently 20% of

the gross interest distribution.

• If you’re an additional rate taxpayer, you will have to pay additional income tax of currently

25% of the gross interest distribution.

WHERE YOU RECEIVE DIVIDEND DISTRIBUTIONS:

Income (the yield, dividend or interest) from these funds can be distributed or accumulated

within the fund. You’ll pay tax on any dividends you receive over £5,000 pa at the following rates:

• 7.5% on dividend income within the basic rate income tax band

• 32.5% on dividend income within the higher rate income tax band

• 38.1% on dividend income within the additional rate income tax band

ENABLE INDEPENDENT FINANCIAL LIFE PLANNERS IS A TRADING STYLE OF ENABLE INDEPENDENT LIMITED

ENABLE INDEPENDENT LIMITED IS AUTHORISED AND REGULATED BY THE FINANCIAL CONDUCT AUTHORITY. Version 2017 - April