Page 32 - 2017 INVESTMENT PHILOSOPHY - May 2017

P. 32

HOW SAFE ARE MY INVESTMENTS?

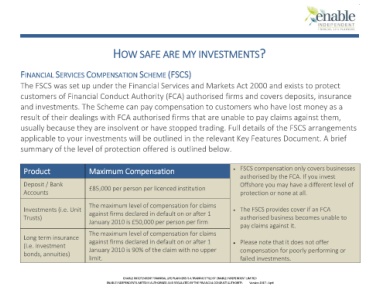

FINANCIAL SERVICES COMPENSATION SCHEME (FSCS)

The FSCS was set up under the Financial Services and Markets Act 2000 and exists to protect

customers of Financial Conduct Authority (FCA) authorised firms and covers deposits, insurance

and investments. The Scheme can pay compensation to customers who have lost money as a

result of their dealings with FCA authorised firms that are unable to pay claims against them,

usually because they are insolvent or have stopped trading. Full details of the FSCS arrangements

applicable to your investments will be outlined in the relevant Key Features Document. A brief

summary of the level of protection offered is outlined below.

Product Maximum Compensation • FSCS compensation only covers businesses

authorised by the FCA. If you invest

Deposit / Bank Offshore you may have a different level of

£85,000 per person per licenced institution

Accounts protection or none at all.

The maximum level of compensation for claims

Investments (i.e. Unit against firms declared in default on or after 1 • The FSCS provides cover if an FCA

Trusts) authorised business becomes unable to

January 2010 is £50,000 per person per firm

pay claims against it.

The maximum level of compensation for claims

Long term insurance

against firms declared in default on or after 1 • Please note that it does not offer

(i.e. investment

January 2010 is 90% of the claim with no upper compensation for poorly performing or

bonds, annuities)

limit. failed investments.

ENABLE INDEPENDENT FINANCIAL LIFE PLANNERS IS A TRADING STYLE OF ENABLE INDEPENDENT LIMITED

ENABLE INDEPENDENT LIMITED IS AUTHORISED AND REGULATED BY THE FINANCIAL CONDUCT AUTHORITY. Version 2017 - April