Page 16 - P6 Slide Taxation - Lecture Day 3 - VAT Part 1

P. 16

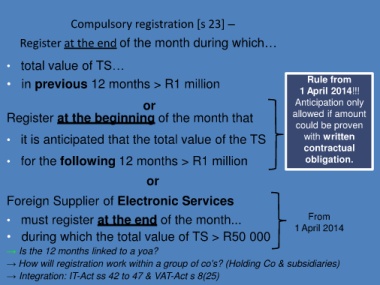

Compulsory registration [s 23] –

Register at the end of the month during which…

• total value of TS…

• in previous 12 months > R1 million Rule from

1 April 2014!!!

or Anticipation only

Register at the beginning of the month that allowed if amount

could be proven

• it is anticipated that the total value of the TS with written

contractual

• for the following 12 months > R1 million obligation.

or

Foreign Supplier of Electronic Services

• must register at the end of the month... From

1 April 2014

• during which the total value of TS > R50 000

→ Is the 12 months linked to a yoa?

→ How will registration work within a group of co's? (Holding Co & subsidiaries)

→ Integration: IT-Act ss 42 to 47 & VAT-Act s 8(25)