Page 18 - P6 Slide Taxation - Lecture Day 3 - VAT Part 1

P. 18

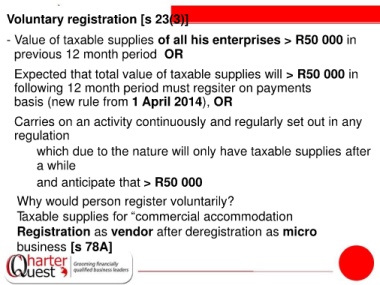

Voluntary registration [s 23(3)]

- Value of taxable supplies of all his enterprises > R50 000 in

previous 12 month period OR

- Expected that total value of taxable supplies will > R50 000 in

following 12 month period must regsiter on payments

basis (new rule from 1 April 2014), OR

- Carries on an activity continuously and regularly set out in any

regulation

• which due to the nature will only have taxable supplies after

a while

• and anticipate that > R50 000

- Why would person register voluntarily?

- Taxable supplies for “commercial accommodation

- Registration as vendor after deregistration as micro

business [s 78A]