Page 65 - P6 Slide Taxation - Lecture Day 3 - VAT Part 1

P. 65

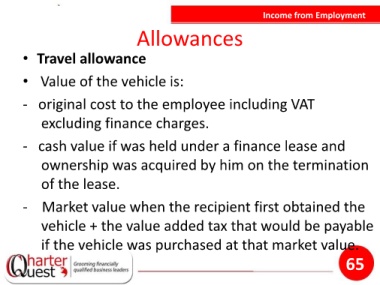

Income from Employment

Allowances

• Travel allowance

• Value of the vehicle is:

- original cost to the employee including VAT

excluding finance charges.

- cash value if was held under a finance lease and

ownership was acquired by him on the termination

of the lease.

- Market value when the recipient first obtained the

vehicle + the value added tax that would be payable

if the vehicle was purchased at that market value.

65