Page 66 - P6 Slide Taxation - Lecture Day 3 - VAT Part 1

P. 66

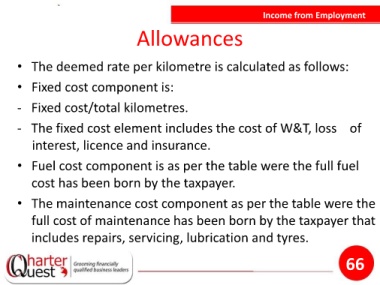

Income from Employment

Allowances

• The deemed rate per kilometre is calculated as follows:

• Fixed cost component is:

- Fixed cost/total kilometres.

- The fixed cost element includes the cost of W&T, loss of

interest, licence and insurance.

• Fuel cost component is as per the table were the full fuel

cost has been born by the taxpayer.

• The maintenance cost component as per the table were the

full cost of maintenance has been born by the taxpayer that

includes repairs, servicing, lubrication and tyres.

66