Page 71 - P6 Slide Taxation - Lecture Day 3 - VAT Part 1

P. 71

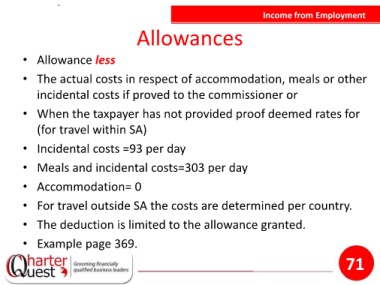

Income from Employment

Allowances

• Allowance less

• The actual costs in respect of accommodation, meals or other

incidental costs if proved to the commissioner or

• When the taxpayer has not provided proof deemed rates for

(for travel within SA)

• Incidental costs =93 per day

• Meals and incidental costs=303 per day

• Accommodation= 0

• For travel outside SA the costs are determined per country.

• The deduction is limited to the allowance granted.

• Example page 369.

71