Page 106 - AAA Integrated Workbook STUDENT S18-J19

P. 106

Chapter 73 4

Exam focus

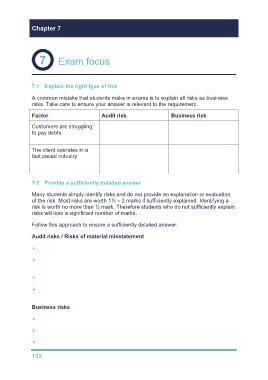

7.1 Explain the right type of risk

A common mistake that students make in exams is to explain all risks as business

risks. Take care to ensure your answer is relevant to the requirement.

Factor Audit risk Business risk

Customers are struggling Receivables may be Bad debts may arise

to pay debts overstated if bad debts are reducing the profit of the

not written off company

The client operates in a Inventory may be Inventory may have to be

fast paced industry overstated if the inventory written off reducing the

is obsolete and NRV is profits of the company

lower than cost

7.2 Provide a sufficiently detailed answer

Many students simply identify risks and do not provide an explanation or evaluation

of the risk. Most risks are worth 1½ – 2 marks if sufficiently explained. Identifying a

risk is worth no more than ½ mark. Therefore students who do not sufficiently explain

risks will lose a significant number of marks.

Follow this approach to ensure a sufficiently detailed answer:

Audit risks / Risks of material misstatement

Identify the information from the scenario that creates the potential risk.

If numbers are provided, calculate whether the balance is material. This helps to

assess whether or not the risk is significant.

State the required accounting treatment from the relevant accounting standard.

State the risk to the financial statements if the required treatment is not

followed.

Business risks

Identify the information from the scenario creating the risk.

Explain the impact it will have on the business operations.

Explain the financial impact to the company e.g. impact on profit or cash flow.

102