Page 99 - AAA Integrated Workbook STUDENT S18-J19

P. 99

Planning, materiality and assessing the risk of material misstatement

The financial statements will be materially misstated if they are not prepared in

accordance with accounting standards.

In order for the auditor to identify material misstatement they need to know what the

appropriate accounting treatment is and whether it has been complied with.

When evaluating the risk of material misstatement it is crucial to discuss the specific

impact of the risk on the financial statements, i.e.

The specific account balance, transaction or disclosure affected

Whether the item might be overstated, understated, omitted, inappropriately

recognised, etc.

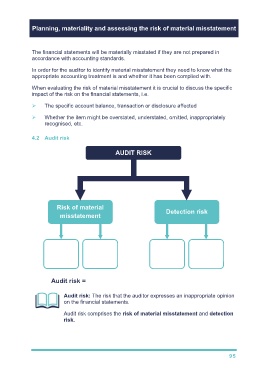

4.2 Audit risk

AUDIT RISK

Risk of material

misstatement Detection risk

Inherent Control Sampling Non-

risk risk risk sampling

risk

Audit risk = Inherent risk × Control risk × Detection risk

Audit risk: The risk that the auditor expresses an inappropriate opinion

on the financial statements.

Audit risk comprises the risk of material misstatement and detection

risk.

95