Page 49 - P6 Slide Taxation - Lecture Day 7 - Various Topics

P. 49

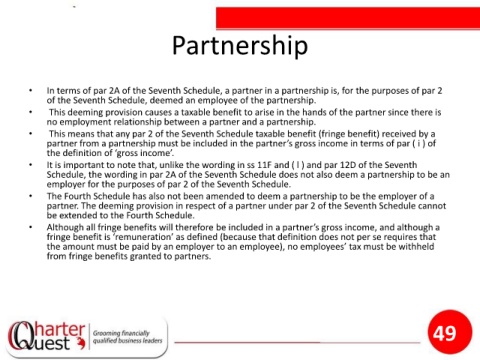

Partnership

• In terms of par 2A of the Seventh Schedule, a partner in a partnership is, for the purposes of par 2

of the Seventh Schedule, deemed an employee of the partnership.

• This deeming provision causes a taxable benefit to arise in the hands of the partner since there is

no employment relationship between a partner and a partnership.

• This means that any par 2 of the Seventh Schedule taxable benefit (fringe benefit) received by a

partner from a partnership must be included in the partner’s gross income in terms of par ( i ) of

the definition of ‘gross income’.

• It is important to note that, unlike the wording in ss 11F and ( l ) and par 12D of the Seventh

Schedule, the wording in par 2A of the Seventh Schedule does not also deem a partnership to be an

employer for the purposes of par 2 of the Seventh Schedule.

• The Fourth Schedule has also not been amended to deem a partnership to be the employer of a

partner. The deeming provision in respect of a partner under par 2 of the Seventh Schedule cannot

be extended to the Fourth Schedule.

• Although all fringe benefits will therefore be included in a partner’s gross income, and although a

fringe benefit is ‘remuneration’ as defined (because that definition does not per se requires that

the amount must be paid by an employer to an employee), no employees’ tax must be withheld

from fringe benefits granted to partners.

49