Page 50 - P6 Slide Taxation - Lecture Day 7 - Various Topics

P. 50

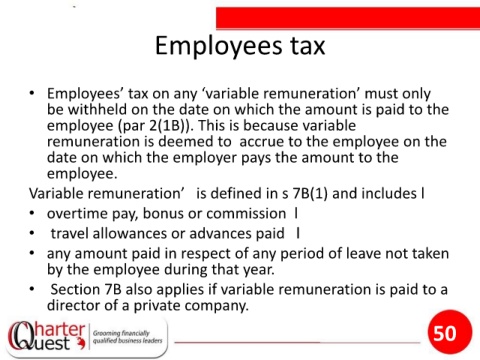

Employees tax

• Employees’ tax on any ‘variable remuneration’ must only

be withheld on the date on which the amount is paid to the

employee (par 2(1B)). This is because variable

remuneration is deemed to accrue to the employee on the

date on which the employer pays the amount to the

employee.

Variable remuneration’ is defined in s 7B(1) and includes l

• overtime pay, bonus or commission l

• travel allowances or advances paid l

• any amount paid in respect of any period of leave not taken

by the employee during that year.

• Section 7B also applies if variable remuneration is paid to a

director of a private company.

50