Page 155 - Microsoft Word - 00 CIMA F1 Prelims STUDENT 2018.docx

P. 155

Currency risk management

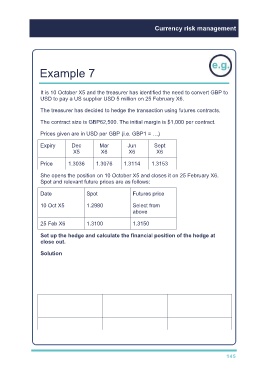

Example 7

It is 10 October X5 and the treasurer has identified the need to convert GBP to

USD to pay a US supplier USD 5 million on 25 February X6.

The treasurer has decided to hedge the transaction using futures contracts.

The contract size is GBP62,500. The initial margin is $1,000 per contract.

Prices given are in USD per GBP (i.e. GBP1 = …)

Expiry Dec Mar Jun Sept

X5 X6 X6 X6

Price 1.3036 1.3076 1.3114 1.3153

She opens the position on 10 October X5 and closes it on 25 February X6.

Spot and relevant future prices are as follows:

Date Spot Futures price

10 Oct X5 1.2980 Select from

above

25 Feb X6 1.3100 1.3150

Set up the hedge and calculate the financial position of the hedge at

close out.

Solution

Step 1

Buy or Sell?

This is driven by the currency the contract is in. Learn this table:

Contract currency Receipt Payment

Contract in £ Buy Sell

Contract in $ Sell Buy

In this case, contract in £, it’s a payment so sell

145