Page 160 - Microsoft Word - 00 CIMA F1 Prelims STUDENT 2018.docx

P. 160

Chapter 12

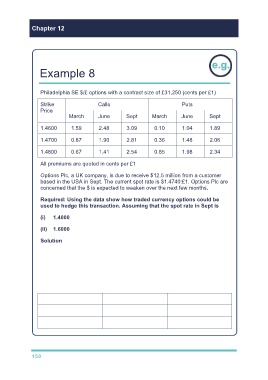

Example 8

Philadelphia SE $/£ options with a contract size of £31,250 (cents per £1)

Strike Calls Puts

Price

March June Sept March June Sept

1.4600 1.59 2.48 3.09 0.10 1.04 1.89

1.4700 0.87 1.90 2.81 0.36 1.48 2.06

1.4800 0.67 1.41 2.54 0.85 1.98 2.34

All premiums are quoted in cents per £1

Options Plc, a UK company, is due to receive $12.5 million from a customer

based in the USA in Sept. The current spot rate is $1.4740:£1. Options Plc are

concerned that the $ is expected to weaken over the next few months.

Required: Using the data show how traded currency options could be

used to hedge this transaction. Assuming that the spot rate in Sept is

(ii) 1.6000

Solution

Step 1

Call or put option?

This is driven by the currency the contract is in.

Learn this table:

Contract currency Receipt Payment

Contract in £ Call Put

Contract in $ Put Call

150