Page 169 - Microsoft Word - 00 CIMA F1 Prelims STUDENT 2018.docx

P. 169

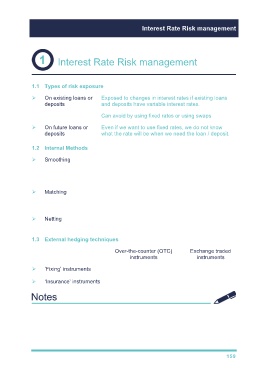

Interest Rate Risk management

Interest Rate Risk management

1.1 Types of risk exposure

On existing loans or Exposed to changes in interest rates if existing loans

deposits and deposits have variable interest rates.

Can avoid by using fixed rates or using swaps

On future loans or Even if we want to use fixed rates, we do not know

deposits what the rate will be when we need the loan / deposit.

1.2 Internal Methods

Smoothing Company has a balance between its fixed rate and

floating rate borrowing.

Natural hedge against changes in interest rates.

Matching The company matches its assets and liabilities to have

a common interest rate (e.g. loan and investment both

have floating rates).

Netting The company aggregates all positions, both assets and

liabilities, to determine its net exposure.

1.3 External hedging techniques

Over-the-counter (OTC) Exchange traded

instruments instruments

‘Fixing’ instruments Forward rate agreements (FRAs) Interest rate futures

‘Insurance’ instruments Interest rate guarantees (IRG) Interest rate options

159