Page 172 - Microsoft Word - 00 CIMA F1 Prelims STUDENT 2018.docx

P. 172

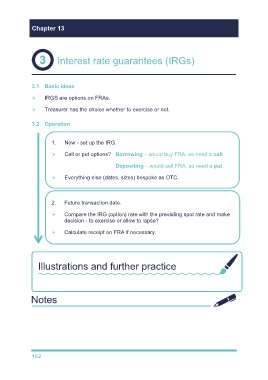

Chapter 13

Interest rate guarantees (IRGs)

3.1 Basic ideas

IRGS are options on FRAs.

Treasurer has the choice whether to exercise or not.

3.2 Operation

1. Now - set up the IRG.

Call or put options? Borrowing – would buy FRA, so need a call

Depositing – would sell FRA, so need a put

Everything else (dates, sizes) bespoke as OTC.

2. Future transaction date.

Compare the IRG (option) rate with the prevailing spot rate and make

decision - to exercise or allow to lapse?

Calculate receipt on FRA if necessary.

Illustrations and further practice

Now try TYU 3 in Chapter 13

162