Page 175 - Microsoft Word - 00 CIMA F1 Prelims STUDENT 2018.docx

P. 175

Interest Rate Risk management

Interest rate futures

4.1 Features

Two types – short term interest rate futures (STIRs) and long term bond futures.

In both cases the underlying asset can be viewed as buying or selling bonds

'Price' = 100 – interest rate.

Size of loan Duration of loan

Number of contracts = ×

Size of contract Duration of contract

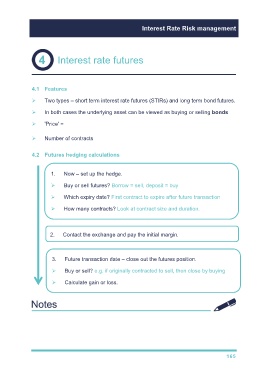

4.2 Futures hedging calculations

1. Now – set up the hedge.

Buy or sell futures? Borrow = sell, deposit = buy

Which expiry date? First contract to expire after future transaction

How many contracts? Look at contract size and duration.

2. Contact the exchange and pay the initial margin.

3. Future transaction date – close out the futures position.

Buy or sell? e.g. if originally contracted to sell, then close by buying

Calculate gain or loss.

165