Page 178 - Microsoft Word - 00 CIMA F1 Prelims STUDENT 2018.docx

P. 178

Chapter 13

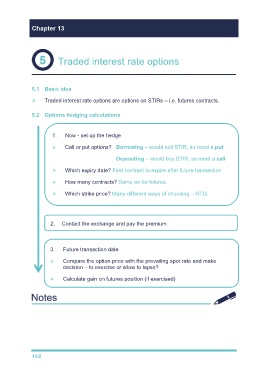

Traded interest rate options

5.1 Basic idea

Traded interest rate options are options on STIRs – i.e. futures contracts.

5.2 Options hedging calculations

1. Now - set up the hedge

Call or put options? Borrowing – would sell STIR, so need a put

Depositing – would buy STIR, so need a call

Which expiry date? First contract to expire after future transaction

How many contracts? Same as for futures.

Which strike price? Many different ways of choosing – RTQ.

2. Contact the exchange and pay the premium

3. Future transaction date

Compare the option price with the prevailing spot rate and make

decision – to exercise or allow to lapse?

Calculate gain on futures position (if exercised)

168